Social Norms and Equity Investment Behaviour During the Financial Crisis

Megan Brown[1], Department of Economics, University of Warwick

Abstract

This article considers the role of social influences in motivating stock market participants' behaviour through investigating sin stocks. These are the equities of firms involved in promoting what is typically viewed as sin-seeking behaviour, such as tobacco, alcohol and gambling companies. Social attitudes regarding sin may cause these firms' stocks to be overlooked in the equity market. Using data for over 4700 US companies from 2000 to 2012, the extent of disparities in institutional ownership and coverage by analysts of sin and non-sin stocks is analysed. Evidence is found in support of the norm-constraint hypothesis in the form of lower institutional ownership and analyst coverage of sin stocks relative to the wider stock universe, controlling for financial variables. Since the financial crisis, a period not previously explored in the literature, the difference in investment in sin and non-sin stocks has reduced, implying greater importance of financial incentives relative to social concerns to investors in the weaker economic climate. The difference in analyst coverage of sin and non-sin stocks has broadened, arguably attributable to individuals being more susceptible to social norm constraints than institutions in economic downturns.

Keywords: Sin stocks, social values, norms, equity, investment behaviour, financial crisis, stock market, alcohol, tobacco, gambling.

Introduction

Societal norms significantly impact human behaviour, to the point where social values affect economic values. One manifestation of this concept is the existence of discrimination, whereby certain groups are favoured or shunned due to characteristics that classical economics would deem unrelated to the decision to interact with them, such as race or gender. Economists have typically considered discrimination in an employment context, yet it may not only be at work in the labour market, but also in the stock market. An intriguing facet of investor behaviour is the apparent neglect of sin stocks, the equity of firms whose operations are widely seen as encouraging vice (Kacperczyk and Hong, 2009: 15), such as tobacco, alcohol, adult entertainment, weapons and gambling companies. Possibly due to the negative connotations of such firms, investors may ignore their shares, despite evidence of high returns (Fabozzi, Ma and Oliphant, 2008: 1; Kacperczyk and Hong, 2009: 15).

Capital markets play a huge role within the economy. The size of the global stock market is estimated to be $57 trillion (McKinsey & Company, 2011). Traditional finance theories hold that stocks' values should only be determined by their unique properties of risk and return; if personal values placed upon stocks by individuals also have an impact, market agents are arguably not maximising returns in line with standard economic motives. The enactment of social policies, such as the official clinical association between cancer and smoking, causing shifts in attitudes, may impact upon the workings of financial markets. For both individuals and institutions, opportunities to generate greater returns may exist if investors choose to ignore social norms and invest in sin stocks. Institutional investors such as pension plans could incur a financial loss in conforming to social norms rather than holding sin stocks, while mutual and hedge funds might avoid the constraints of norm adherence, hence generating higher returns. Whether or not they capitalise upon this opportunity, investors must consider the impact of social norms when selecting and managing investment portfolios.

Previous literature (Kacperczyk and Hong, 2009: 16) has found a systematic bias against sin stocks in the financial market. This article seeks to investigate how the global financial crisis has impacted the behaviour of stock market participants in their consideration of social norms regarding investment decisions, by posing the question: How has institutional investment in and analyst coverage of sin stocks changed during the course of the financial crisis?

The research essentially asks if the avoidance of sin depends on the level of wealth.On the one hand, the increased scrutiny that the financial sector is now under since the crisis may have led to stricter adherence to social norms. Yet on the other hand, the difficult economic climate could have given rise to a situation where profit motive is of greater importance than social acceptability. These possibilities are explored by looking at changes in the key variables, ownership and coverage, over the pre- and post-crisis period, utilising panel data regressions and relevant statistical tests.

If the occurrence of economic crises influence social norm effects within stock markets, this disputes the theory that norm adherence is still observed even when disobedience leads to a financial gain (Akerlof, 1980: 749). There may be a limit to how far investors will conform to social norms during times of economic distress. From a policymaker's perspective, this indicates that stock market participants behave differently in response to social influences in different economic environments – the expected reaction must be considered when enacting policies that will influence capital markets.

The findings of this research indicate that sin stock avoidance is present, with lower levels of institutional ownership and analyst coverage of sin stocks relative to the wider equity market. Further, the difference in investment in sin and non-sin stocks has reduced since the crisis, implying greater importance of financial incentives relative to social concerns for investors in the weaker economic climate. However, the difference in analyst coverage of sin and non-sin stocks has broadened, possibly attributable to individuals being more susceptible to social norm constraints than institutions in economic downturns.

Literature review

Becker (1957) was among the first to rigorously model discrimination, presenting a theory where economic agents can have tastes over employees due to non-pecuniary features. No explanation is provided for such tastes; rather it is assumed there is a preference against certain groups that can be treated in the same way as classical preferences over goods and services. In the labour market context, if the shunned group can be hired for a lower wage due to insufficient demand and all workers exhibit equal productivity, avoiding interaction serves to impose a cost upon the firm. This analysis has since been extended by Arrow (1972: 83), Akerlof (1980: 749) and Romer (1984: 717), who argue that although conforming to social norms may be costly, creating financial gain for those who disobey, such habits persist.

Kacperczyk and Hong (2009: 16) theorise that there are social preferences against sin stocks and investors may incur financial costs in following such customs. Using dummy variables for whether firms are classed as 'sin' in regressions on US equity data, they find supportive evidence in three forms: higher expected returns of sin stocks; fewer holdings by 'norm-constrained' investors (such as pension funds, universities, banks and insurance firms) relative to mutual or hedge funds, which are seen as 'natural arbitrageurs' (Kacperczyk and Hong, 2009: 15); and less coverage from analysts. Despite their economic merits, sin stock demand is relatively low, implying that taste may factor in demand determination. The global persistence of high sin stock returns is found by Fabozzi, Ma and Oliphant (2008: 1), while Salaber (2007: 2) aims to explain such returns beyond the broad title of social norms, studying the causes of European sin stock returns. Contributing factors include legal and cultural reasons such as religion, excise taxation and litigation risk (both higher for sin firms, a logical reason to shun their stocks), implying that both economic and social influences are at play.

Kim and Venkatachalam (2011: 415) further attempt to identify an economic rationale for this behaviour, asking whether substandard financial reporting quality within sin firms, increasing informational risk when investing in such firms, can explain higher expected returns of sin stocks. However, they find evidence to the contrary, both in terms of timely recognition of losses and the degree to which earnings for future cash flows are correctly predicted. This lends further credibility to the presence of social norm effects in stock markets, as sin stocks remain a neglected subset despite higher expected returns and financial reporting quality.

The eminence of social norm effects on stock markets has grown in line with the rise of Socially Responsible Investment (SRI), which considers social good alongside financial gain by favouring or shunning certain firms. In 2010, the value of assets in socially screened portfolios was $3.07 trillion, a 34% rise from five years earlier (Forum for Sustainable and Responsible Investment, 2010). Renneborg, Horst and Zhang (2007) and Adler and Kritzman (2008: 52) suggest that the cost of SRI is substantial; an equity portfolio subjected to screening constraints will underperform one without, on a risk-adjusted basis. Capelle-Blancard and Monjon (2012: 1) find that sectorial screens such as sin stock avoidance reduce funds' financial performance more than any other screening process. Recognising the importance of these effects, Statman, Fisher and Anginer (2008: 9) have created a behavioural asset-pricing model allowing both objective and subjective risk to affect equity demand.

Not since the 1930s has the world seen such an astonishing economic meltdown as that which began in 2007. The financial crisis sparked by the bursting of the US housing and credit bubble, precipitating a shutdown of credit markets, created substantial damages to equity and real estate wealth. Such crises are endemic to the effective functioning of stock markets (Senbet and Gande, 2009: 3), depressing returns, inducing major volatility and increasing risk (Chaudhury, 2011: 67). Equity trading has not yet recovered, even continuing to decline, with investors moving away from equity in favour of less risky securities such as bonds (Popper, 2012). This change in investment preferences is noted as a shortcoming of the research – however, the key changes that this research considers are the differences between ownership of and investment in sin and non-sin stocks, rather than the total level. This comparative view remains pertinent despite the shift in investment preferences. Both the economic theories on norm constraints and the observation of post-crisis capital market contraction form hypotheses that this research seeks to address.

Empirical strategy

Methodology

A number of press reports (for example Borzykowki, 2012; Brown, 2012; Harris, 2012; Steen, 2012) suggest that sin stocks are an economic curiosity in their tendency to outperform more socially responsible alternatives, yet research finds they remain neglected by investors. In order to consider how far Becker's (1957) theories of discrimination are applicable in this context, two dimensions are examined here: institutional ownership, the proportion of a company's total shares in issue held by institutional investors; and analyst coverage, the number of investment analysts who produce estimates on a firm's future expected equity performance, both measured at each year end. The former is indicative of buyer demand for a company's shares, while the latter provides a complementary measure considering the extent to which stocks are paid attention rather than ignored.

Together, both variables present a broader picture of the extent to which sin stocks, identified here by a non-zero value of the dummy variable sin, are shunned in favour of more reputable alternatives, controlling for a set of financial characteristics such as company size, share price and returns. The issue of whether a firm is sinful or not is far more nuanced than a dummy variable can portray; however, this approach must be taken due to the availability of data. Within the collected dataset, firms are identified as belonging to a particular industry if at least 30% of their activities are within that industry; therefore a dummy variable is the most effective method of identifying sin stocks given the data constraints.

The impact of the financial crisis is considered through the inclusion of a dummy variable separating the pre- and post-crisis periods, in addition to a multiplicative term describing the interaction of the sin and post-crisis variables, in order to infer the extent to which the crisis has affected social norm effects within stock markets.

These are permutations of the following model:

Institutional ownership and analyst coverage are measures of market participant behaviour, while the sin variables measure subjective social norms. X' comprises the set of objective financial incentives, as defined below. There is a broad consensus within the literature that the variables chosen to enter this set would typically affect the behaviour of agents within stock markets, through their effects on expected risk and return. All variables are measured for firm i at the end of year t. Institutional ownership is measured in percentage terms and the logarithm of analyst coverage is modelled, in order to consider changes.

| Variables | Description |

|---|---|

| Dependent | |

| Institutional ownership (insto) | The percentage of shares of company i held by institutions at the end of year t: number of shares held by institutions divided by total shares outstanding |

| Analyst coverage (lanalysts1) | The natural logarithm of one plus the number of analysts covering firm i at the end of year t |

| Explanatory | |

| sin | 1 if firm i is classified as a sin firm, 0 otherwise |

| post | 1 if the observation occurred from 2007 onwards, 0 otherwise |

| sinpost | The interaction term of the dummy variables sin and post, measuring the additional effect of being a sin compared non-sin firm for post- compared to pre-crisis |

| lsize | The natural logarithm of the firm's market capitalisation: price times shares outstanding |

| iprice | The inverse of firm i's share price at the end of year t |

| beta | The beta of firm's i's industry in year t, measuring volatility |

| returns | The average monthly returns on firm i's stock during year t |

| nasdaq | 1 if firm i is included on the NASDAQ stock index, 0 otherwise |

| sp500 | 1 if firm i is included on the S&P500 stock index, 0 otherwise |

| usgdp | US GDP growth during year t, measured in percentage terms |

Table 1: Variable descriptions

Initially, pooled OLS regressions were estimated, before considering further panel data methods: fixed effects, controlling for omitted variables that differ between cases but are constant over time, and random effects, allowing some omitted variables to be constant over time but vary between cases, and others to be fixed between cases but vary across time. These empirical methods were deployed with the aim of analysing the validity of the following hypotheses:

Hypothesis I: Institutional ownership and analyst coverage will be lower for sin firms when compared to non-sin firms (negative 1), controlling for the financial variables within the set X'.

Hypothesis II: Institutional ownership and analyst coverage for both categories of company will be lower following the crisis and consequent recession (negative 2), similarly controlling for financial variables.

Hypothesis III: Since the financial crisis, one of the following two scenarios will have occurred: i. Institutions are now under increased external scrutiny, augmenting the norm-constraint effect (negative 3). ii. The tough economic climate means it is more important to perform as strongly as possible in pecuniary terms, thus profit motive has grown in influence relative to norm constraints (positive 3).

In contemplating these hypotheses, it is necessary to note the bounds of the research. Immediately, the challenge of defining 'sin' is presented. Following previous works (Kacperczyk and Hong, 2009: 18; Salaber, 2007: 11; Liu, Lu and Veenstra, 2011: 10), this study will focus on the tobacco, alcohol and gambling industries, defining sin companies as any firm with at least 30% of its business activities classified as falling within one of these industries. For an explanation of the sin stock identification process and the list of sin stocks included in the sample, see Appendix A. There is a wealth of evidence to demonstrate the addictive properties of tobacco, alcohol and gambling (Kacperczyk and Hong, 2009: 19), as well as the negative implications, both personal and external, of excessive consumption. This presents a solid foundation to define these sins as socially unacceptable practices, while the same is less certain for other arguably sinful industries, such as adult entertainment and nuclear power. It is recognised that this is an imperfect method of defining sin stocks. For instance, social norms are likely to change over time and across countries, depending on cultural values, traditions and preferences. It remains, however, a necessary exercise to set the definition in some manner, therefore this is done following previous research.

A further issue is grouping 'sin stocks' into one category rather than disaggregating by industry as there may be variations in social acceptance levels of different vices. Similarly, industry-specific factors might influence stock market participants' attitudes and behaviour towards sin companies. Although sin stocks may share the common feature of being collectively shunned by socially responsible investors, Sizemore (2012) points to the difference in tobacco and alcohol being defensive consumer staples, while the performance of and demand for gambling stocks is dependent to a greater extent upon the condition of the travel and tourism industries, thus far more cyclical in nature. Controlling for unobserved heterogeneity across firms mitigates any limitation this may pose in empirical analysis.

Data presentation

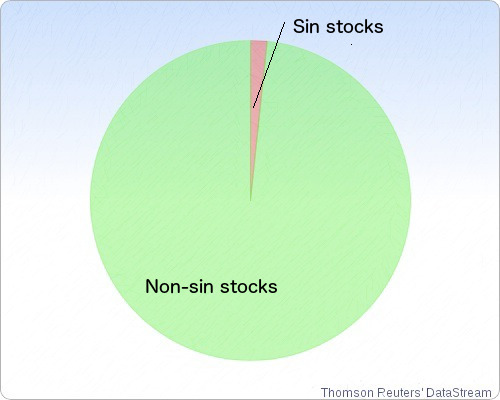

Data on company financials was extracted from Thomson Reuters' DataStream, analyst coverage date from Thomson One Banker and US GDP data from The World Bank database. The compiled dataset comprises all non-financial US stocks available in DataStream, including dead stocks to mitigate any survivorship bias, resulting in a sample size of 4,788 stocks, of which 80 are sin stocks. The sample period is 2000–2012 (and from 2003 for ownership data), giving 62,244 individual observations, forming a panel.

Using panel data provides the ability to identify individual-specific and time effects through controlling for unobserved heterogeneity, a key concern in creating bias if not addressed. Within this dataset, an immediate issue regarding potential sources of bias is the small number of sin stocks relative to the wider stock universe. However, the underlying reason for this may in fact be in agreement with the spirit of Hypothesis I, in that publically traded sin stocks may not be in abundance as many vice firms are privately held in order to avoid the discrimination their equity faces on the stock market. Endogeniety could also be an issue – this is tested statistically using the Hausman-Taylor model and the main variable of focus, the sin stock dummy, is found not to be endogenous. Further statistical considerations are: problems of attrition, as not all firms have inputs for every variable in every time period (of the 62,244 observations, 20,887 have inputted data for ownership and 17,956 for coverage); the relatively short time series dimension; measurement errors; and selectivity precipitating possible omission of relevant variables and sample selection bias. A rebuttal to the latter point is that the variables selected follow the methodologies of previous works (Kacperczyk and Hong, 2009: 19; Liu, Lu and Veenstra, 2011: 10) with the aim of achieving the best model specification including all variables deemed to be pertinent.

Figure 1: Proportion of sin stocks to non-sin stocks

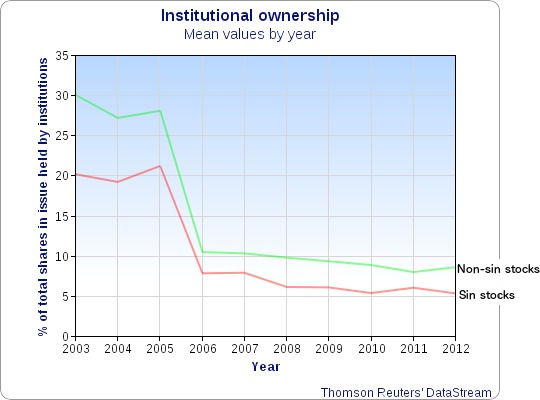

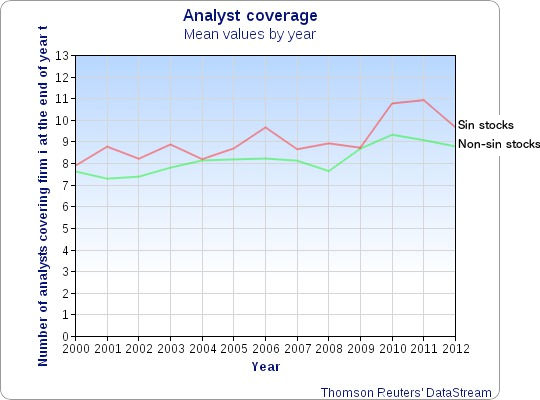

Preliminary analysis reveals that institutional ownership tends to be consistently higher among non-sin compared to sin firms, exhibiting a clear drop for both as the early stages of the crisis took hold, while analyst coverage appears considerably more constant across both firm types and time. The significant drop in institutional ownership occurs at the end of 2006, rather than 2007 as we might expect; the reason for this is likely to be that '2006 was the year of the incredible shrinking stock market' (Barr, 2006: 1), when a record number of shares withdrew from public markets. However, ownership did not bounce back in line with positive predictions that the decline would bode well for 2007, indicating a role for the financial crisis in maintaining this contraction. Further summary statistics are outlined in Appendix B.

Figure 2: Institutional ownership, mean values by year for sin and non-sin stocks

Figure 3: Analyst coverage, mean values by year for sin and non-sin stocks

Results

| Explanatory variables | Institutional ownership | Analyst coverage |

|---|---|---|

| sin | -8.105*** (1.312) |

-0.0661 (0.0521) |

| post | -13.84*** (0.216) |

0.0312*** (0.00567) |

| sinpost | 3.248*** (1.040) |

-0.122*** (0.0265) |

| lsize | 2.119*** (0.0766) |

0.302*** (0.00328) |

| iprice | 0.00196*** (0.000695) |

0.0283*** (0.00526) |

| beta | -0.603*** (0.122) |

0.0163*** (0.00274) |

| returns | -3.11e-08 (2.24e-07) |

0.000112 (8.34e-05) |

| nasdaq | 4.063*** (0.416) |

0.157 *** (0.0178) |

| sp500 | -0.336 (0.698) |

0.239*** (0.0258) |

| usgdp | -0.106** (-0.0496) |

-0.00833*** (0.00136) |

| constant | 11.71*** (0.443) |

-0.243*** (0.0235) |

| R2 | 0.289 | 0.639 |

| Observations | 20,887 | 17,956 |

Table 2: Headline results using random effects regression. Standard errors in parentheses.

***Significant to the 1% level, **significant to the 5% level, *significant to the 10% level.

Pooled OLS regression results

| Explanatory variables | Institutional ownership | Analyst coverage |

|---|---|---|

| sin | -9.757*** (0.969) |

-0.0673** (0.0270) |

| post | -14.14*** (0.266) |

0.00556 (0.00861) |

| sinpost | 3.103** (1.291) |

-0.135*** (0.0410) |

| lsize | 3.169*** (0.0514) |

0.328*** (0.00264) |

| iprice | 0.00211*** (0.000708) |

0.0266*** (0.00527) |

| beta | 0.180 (0.113) |

0.0616*** (0.00345) |

| returns | -2.18e-08 (2.49e-07) |

0.000132 (0.000103) |

| nasdaq | 2.197*** (0.227) |

0.161*** (0.00745) |

| sp500 | -5.736*** (0.394) |

0.125*** (0.0116) |

| usgdp | -0.220*** (0.0615) |

-0.0122*** (0.00213) |

| constant | 7.441*** (0.356) |

-0.392*** (0.0186) |

| R2 | 0.304 | 0.645 |

| Observations | 20,887 | 17,956 |

Table 3: Pooled OLS regression results. Standard errors in parentheses.

***Significant to the 1% level, **significant to the 5% level, *significant to the 10% level.

Fixed effects regression results

| Explanatory variables | Institutional ownership | Analyst coverage |

|---|---|---|

| sin | (omitted) | (omitted) |

| post | -13.01*** (0.215) |

0.0385*** (0.00576) |

| sinpost | 3.682*** (1.025) |

-0.122*** (0.0265) |

| lsize | -0.640*** (0.128) |

0.295*** (0.00402) |

| iprice | 0.00139* (0.000746) |

0.0590*** (0.0104) |

| beta | -1.344*** (0.139) |

0.0111*** (0.00283) |

| returns | 6.59e-08 (2.28e-07) |

6.64e-05 (9.12e-05) |

| nasdaq | (omitted) | (omitted) |

| sp500 | (omitted) | (omitted) |

| usgdp | 0.169*** (0.0497) |

-0.00674*** (0.00137) |

| constant | 28.32*** (0.698) |

-0.0350*** (0.0272) |

| R2 | 0.252 | 0.311 |

| Observations | 20,887 | 17,956 |

Table 4: Fixed effects regression results. Standard errors in parentheses.

***Significant to the 1% level, **significant to the 5% level, *significant to the 10% level.

The headline results, shown in Table 2, were estimated using a random effects model. Random effects tend to be the most efficient estimation when the data in question covers many observations at the individual level and fewer across time. The outcome of the Mundlak version of the Hausman test and Hausman-Taylor model further confirmed this choice, as shown in Appendix B.

For the institutional ownership model, these results are consistent with subjective social values colouring stock market participants' attitudes towards certain shares. Sin firms see less investment in their stocks than non-sin firms, by a margin of over 8%, controlling for financial factors, while the crisis exerted a detrimental impact on both categories of equity, lessening institutional investment dramatically by 13.8%, supporting Hypotheses I and II. This decisive split between investment in sin and non-sin equity implies that discrimination does feature in stock markets, with sin shares being shunned due to industry orientation rather than measured on fiscal performance.

The occurrence of the financial crisis appears to have lessened the gap between ownership of sin and non-sin stocks, vindicating case ii of Hypothesis III, showcased by the positive coefficient on the difference-indifference estimator sinpost. The additional increase in institutional ownership of sin relative to non-sin stocks for post- compared to pre-crisis is 3.2%. This finding implies that the desire to adhere to social norms has been dampened by the crisis and generating economic profit has become a relatively more important factor, although sin stock ownership remains below that of non-sin shares, indicating that on average social considerations remain dominant.

With regard to analyst coverage, the results are less decisive. Sin firms receive less attention than their peers by a margin of 6.6%, in accordance with Hypothesis I, but this result is not statistically significant. Coverage since the crisis appears 3% higher than that during the pre-crisis period, at odds with Hypothesis II. Here, the impact of the downturn upon the norm-constraint effect has been to widen the divergence between sin and non-sin stock coverage by 12%, illustrated by the negative coefficient on the difference-in-difference estimator sinpost, implying case i of Hypothesis III, a surprising result given the opposite effect is exerted upon institutional investment.

There are numerous possible explanations for this. One is simple: it may be a data failure, with selection bias meaning that relevant data not available for enough firms to produce a reliable result. However, a more considered elucidation could be that individual analysts pay greater attention to social customs than institutions do in difficult economic times.

For instance, diminished job security in the downturn may lead analysts to stick to more conservative spheres, explaining why social norms only exhibit significance in coverage decisions since the crisis. Following this argument, the fact that coverage of all stocks has risen post-crisis is not a surprising result; with certain firms performing poorly or even going out of business, it would be logical for analysts to cover larger portfolios, thus diversifying risk and amplifying the chance of identifying well-performing shares.

Despite the negative coefficient on the difference-in-difference estimator indicating increased constraint of social norms post-crisis, the largest coefficients in the analyst coverage model are those on the logarithm of a firm's size and the dummy variables for whether or not a stock is included in the NASDAQ and S&P500 stock indices. This implies that financial factors continue to bear weight in motivating individual behaviour, which may further explain why the coefficient on the dummy variable sin lacks statistical significance in this model.

These results are generated through estimation of random effects models. The Hausman test on each regression initially suggested a fixed effects model was the best fit; however, random effects tend to be the most appropriate form of panel estimation when the data comprises many observations at the individual level and fewer across time, as is the case here, while with fixed effects the time-invariant regressors, such as the key explanatory variable sin, cannot be investigated. As these variables cannot be estimated under fixed effects, computational problems with the Hausman test, which compares variable coefficients across fixed and random estimations, arise. Therefore, the Mundlak version of the Hausman test was performed (Perales, 2013), leading to estimation of the Hausman-Taylor model. Full regression analysis, including details of checks to the robustness of using random effects models, is provided in Appendix III. Through this method, the assumptions underlying random effects are found to be satisfied, confirming that it is the most efficient form of panel data estimation for both models.

Subsequently, the Chow test for structural change was applied to the models. This is simply a test of whether the coefficients estimated over one group of the data are equal to those over another. In other words, we are testing whether behaviour is the same, as measured by whether the coefficients are the same. The two groups comprise sin and non-sin firms. Running this test on both models confirms the dual presence of a structural break. This further advocates a role for social values in stock market decisions, as market participants make investment and coverage choices in different manners dependent on whether they are considering sin or non-sin stocks.

Conclusion and extensions

Sin stock investment falls short of that within the wider stock universe. Furthermore, the difficult economic climate has given rise to a situation where profit motive has become more important in relation to social norm incentives for institutional investors. Discrimination against sin stocks has been dampened, although not extinguished, by the crisis, implying the amplified importance of outcome-oriented rationality relative to social norm constraints in difficult economic times. In terms of analyst coverage, sin stocks again trail behind more socially acceptable alternatives, while the crisis has heightened the magnitude of this effect, with sin shares being covered even less post-crisis, arguably attributable to individuals being more susceptible to social norm constraints in unfavourable economic conditions.

Due to the infancy of this field of research, potential extensions abound. While this research has focused upon the behaviour of stock market participants, further study may explore that of stocks themselves, considering the pattern of sin stock returns over the crisis period and if they are indeed 'recession-proof' (Brown, 2012: 1). International cultural divergences could also be considered: different societies may exhibit variant levels of acceptance of sin-seeking behaviours due to diverse tastes over what is considered sinful. As Salaber (2007: 4) notes, little research has been devoted to the effects of social norms upon stock markets and even less to markets outside the US. Emerging markets and developing countries would make very interesting case studies, although data difficulties may be more pronounced here.

Possible extensions also include the expansion of the list of companies defined as sin firms, such as weapons, biotechnology, nuclear power and adult entertainment; Fabozzi, Ma and Oliphant (2008: 1) find that returns for all these sin sectors outperform the norm. Another interesting avenue to explore would be further consideration of different social values that may affect investment decisions and stock market behaviour over and above classical financial variables, such as the work by Hong and Kostovetsky (2012) on the impact of political orientation on mutual funds' stock holdings. Further investigation has much potential to provide captivating insights into both the expected and unexpected roles of economics in the nuances of the stock market world.

List of figures

Figure 1: Proportion of sin stocks to non-sin stocks

Figure 2: Institutional ownership, mean values by year for sin and non-sin stocks

Figure 3: Analyst coverage, mean values by year for sin and non-sin stocks

List of tables

Table 1: Variable descriptions

Table 2: Headline results using random effects regression

Table 3: Pooled OLS regression results

Table 4: Fixed effects regression results

Table 5: Coefficients for each of the models with the sample divided into sin and non-sin firms

Appendices

Appendix A: Classification of sin stocks

Identification of sin stocks began with the starting point of Kacperczyk and Hong's (2009) list of sin stocks, based upon industry codes. This was then expanded using the classifications set out by Salaber (2009), defining sin stocks as those in the 'brewers', 'distillers and vintners', 'tobacco' and 'gambling' industry groupings within Thomson Reuters' DataStream

| List of sin stocks | |

|---|---|

| ALTRIA GROUP | ISLE OF CAPRI CASINOS |

| AMERICAS CAR MART | J BOUTARIS & SON HLDG. ORDINARY |

| AMERISTAR CASINOS | KIRIN HOLDINGS |

| AMERITYRE | LAKES ENTM. |

| ANHEUSER-BUSCH INBEV | LEUCADIA NATIONAL |

| ARCHON | LITTLEFIELD |

| BALLY TECHNOLOGIES | LOEWS |

| BINGO COM | LOTTERY &WAGERING SLTN. |

| BOSTON BEER 'A' | MENDOCINO BRW.CO. |

| BOYD GAMING | MGM RESORTS INTL. |

| BROWN-FORMAN 'B' | MONARCH CASINO & RESORT |

| CALL NOW | MTR GAMING GP. |

| CAP.BEV. | MULTIMEDIA GAMES HLDCO. |

| CBR BREWING 'A' | NATIONAL BEVERAGE |

| CENTRAL EUR.DISTRIBUTION | NEVADA GOLD & CASINOS |

| CENTURY CASINOS | NEW WORLD BRANDS |

| CHINA ORGANIC FTLZ. | PENFORD |

| CHURCHILL DOWNS | PENN NAT.GAMING |

| AMBEV PN | PERNOD-RICARD |

| CCU | PINNACLE ENTM. |

| CONSTELLATION BRANDS 'A' | PLYMOUTH RUB. 'A' |

| CONTINENTAL | PML 'A' |

| COOPER TIRE & RUB. | PROGRESSIVE GAMING INTL. |

| CRAFT BREW ALLIANCE | SCHWEITZER-MAUDUIT INT. |

| DIAMONDHEAD CASINO | SCIEN.GAMES 'A' |

| DOUBLE COIN HOLDINGS 'A' | SEABOARD |

| DOVER DOWNS GMG. & ENTM. | SPECTRE GAMING |

| DOVER MOTORSPORTS | STAR SCIENTIFIC |

| ELECTRONIC GAME CARD | TABCORP HOLDINGS |

| ELSINORE | GOODYEAR TIRE & RUB. |

| FLORIDA GAMING | TITAN INTL.ILLINOIS |

| FEMSA 'UBD' | TSINGTAO BREWERY 'A' |

| FULL HOUSE RESORTS | UNIVERSAL |

| GAMETECH INTL. | VECTOR GP. |

| GAMING PTNS.INTL. | CONCHATORO |

| GLOBAL CASINOS | W TECHNOLOGIES |

| GMODELO 'C' | WILLAMETTE VLY.VINEYARDS |

| INTERACTIVE SYSTEMS WWD. | WMS INDUSTRIES |

| INTERAMERICAN GAMING | WORLD RACING GROUP |

| INTL.GAME TECH. | WYNN RESORTS |

Appendix B: Full regression analysis

A note on coefficient interpretation

Institutional ownership is measured in percentage terms, as the proportion of firm i's shares out of the total number in issue that are held by institutional investors. Therefore, we interpret the coefficients on the variables in this model as the unit effects of changes in the dependent variables upon institutional ownership, where the units are measured in percentage terms. For instance, the coefficient of -8.105 on the sin dummy tells us that sin firms (where sin takes the value 1) are invested in 8.105% less than non-sin firms. Analyst coverage takes the natural logarithmic form, measured as the natural logarithm of one plus the number of analysts covering firm i at the end of year t, thus the coefficient of 0.239 on the s&p500 dummy, for instance, tells us analysts cover firms included in the S&P500 stock index 23.9% more than those that are not.

A note on forms of panel data estimation

Panel data provides information on multiple individuals at multiple points in time. Pooled OLS estimation of panel data enables exploitation of all the information in the data, but is often biased as it ignores the influence of unobserved heterogeneity, fundamental differences between individuals (here, firms) within the data, simply including it within the composite error term. Of paramount concern when dealing with panel data is the possibility of unobserved heterogeneity bias. In order to correct for this, alternate forms of panel data estimation may be employed, most typically fixed and random effects. Fixed effects estimations control for time-invariant heterogeneity across individuals, while random effects assume that any time-invariant unobserved heterogeneity is uncorrelated with the explanatory variables. If this is the case, then a random effects model is the preferred form of estimation. The Hausman test can determine which form of estimation is most efficient; however, there can be computational issues with this test, such as the omission of time-invariant variables from the comparison and the underlying assumption that variance is greater in fixed than random effects, which may not be the case. Further, random effects tend to be the most efficient estimation when the data in question covers many observations at the individual level and fewer across time. The Mundlak version of the Hausman test and Hausman-Taylor model can be used to determine the efficiency of random effects through testing if regressors are exogenous thus uncorrelated with unobserved heterogeneity.

Pooled OLS specification tests

Ramsey RESET test for omitted relevant variables

| F-statistic |

Probability > F |

Conclusion |

|

| Institutional ownership |

404.48 |

0.0000 |

Omitted variables |

| Analyst coverage |

500.76 |

0.0000 |

Omitted variables |

Strong evidence exists to suggest there are variables relevant to both models that have been omitted from the regressions. This is not a surprising result, firstly due to the selective nature of the variables within the dataset, and secondly because there are likely to be any number of unobservable factors relevant to the determination of the dependent variables that available data sources do not capture. The model specifications are derived from theory rather than trial-and-error empirical testing, aiming to select the variables deemed logically pertinent to market participants' decision-making,

Breusch-Pagen/Cook-Weinberg test for heteroscedasticity

| Chi2-statistic |

Probability > Chi2 |

Conclusion |

|

| Institutional ownership |

3428.56 |

0.0000 |

Heteroscedasticity |

| Analyst coverage |

19.31 |

0.0000 |

Heteroscedasticity |

The above test considers whether variance within the data is constant across all observations; the results of the test imply that it is not. We would expect variance to change markedly across firms due to natural differences.

Random effects specification tests

Breusch-Pagan Lagrangian Multiplier test

| Chi2-statistic |

Probability > Chi2 |

Conclusion |

|

| Institutional ownership |

10768.18 |

0.0000 |

RE appropriate |

| Analyst coverage |

30316.63 |

0.0000 |

RE appropriate |

This test determines whether random effects (RE) or pooled OLS is more appropriate to estimate the models. The results strongly indicate that random effects are most efficient, as subsequently vindicated by the Hausman-Taylor model.

Hausman test

| Chi2-statistic |

Probability > Chi2 |

Conclusion |

|

| Institutional ownership |

761.98 |

0.0000 |

FE appropriate |

| Analyst coverage |

116.36 |

0.0000 |

FE appropriate |

The Hausman test is used to determine whether correlation exists between firm-specific unobservable effects and the regressors. The results suggests that the use of a fixed effects (FE) model in both estimations would be consistent with the data than RE; however, as the dummy variables sin, nasdaq and sp500 are time invariant, they cannot be estimated using fixed effects, therefore are omitted from the Hausman test comparison, creating problems with computing the test. As such, further consideration must be made as to which form of panel data estimation is most efficient for this data.

Mundlak version of the Hausman test

The Mundlak version of the Hausman test is used to determine the adequacy of the random effects model. To run this test, we generate means of each of the variables in the model and include them in the regression. The joint significance of these generated mean regressors indicates the exogeneity of the unobserved individual effects from the model regressors.

| F-statistic |

Probability > F |

Conclusion |

|

| Institutional ownership |

220.14 |

0.0000 |

Mean regressors exogenous |

| Analyst coverage |

111.47 |

0.0000 |

Mean regressors exogenous |

The mean regressors are strongly significant, thus the Mundlak version of the Hausman test is consistent with the use of random effects. The Hausman-Taylor model further verifies this choice.

Hausman-Taylor model

In order to be able to employ a random effects model that is efficient and consistent, it is further necessary to confirm that the time-invariant variables are exogenous, thus uncorrelated with unobserved effects, in order to ensure than the assumptions underlying random effects are satisfied and the model does not suffer endogeneity bias. The Hausman-Taylor model is used to determine which of the variables included in the model are exogenous. In estimating this model, it is confirmed that the key time-invariant variable, sin, is exogenous in both the institutional ownership and analyst coverage models, illustrated by P>|z| values of 0.319 and 0.266 respectively, thus unobserved heterogeneity is uncorrelated with the explanatory variables here and the assumptions underlying random effects are sound. Therefore, the Hausman-Taylor model is consistent with the use of random effects to estimate this data.

Chow test

| Variable |

Institutional ownership |

Analyst coverage |

||

|---|---|---|---|---|

| Sin |

Non-sin |

Sin |

Non-sin |

|

| post |

-14.17 |

-10.38 |

-.00124 |

-0.0988 |

| lsize |

3.375 |

-0.0726 |

0.347 |

0.124 |

| iprice |

0.00236 |

-0.965 |

0.0323 |

-0.545 |

| beta |

0.0990 |

2.010 |

0.0599 |

0.189 |

| returns |

-4.009e-08 |

-0.00473 |

0.0000102 |

0.00379 |

| nasdaq |

1.943 |

1.579 |

0.167 |

-0.131 |

| sp500 |

-6.895 |

10.211 |

0.0769 |

0.112 |

| usgdp |

-0.242 |

0.103 |

-0.0131 |

-0.0130 |

| Constant |

6.754 |

14.31 |

-0.505 |

1.044 |

Table 5: Coefficients for each of the models with the sample divided into sin and non-sin firms.

The Chow test examines structural change between sin and non-sin firms through testing whether the coefficients estimated over the sin group are equal to those over the non-sin group.

| F-statistic |

Probability > F |

Conclusion |

|

| Institutional ownership |

54.33 |

0.0000 |

Structural break present |

| Analyst coverage |

31.40 |

0.0000 |

Structural break present |

For both models, ample evidence exists to reject the null hypothesis of no structural break between sin and non-sin firms. This implies that there exist fundamental differences in the manner that institutional ownership and analyst coverage of sin and non-sin firms are determined.

Acknowledgements

The author would like to gratefully thank Dr. Christian Soegaard for his invaluable guidance and encouragement throughout the research and writing of this article; Ms. Emma Cragg for her vital assistance during the data collection process; and finally the Reinvention editorial team and anonymous peer reviewers, whose advice, support and patience were absolutely crucial in readying this article for publication.

Notes

[1] Megan Brown graduated from the University of Warwick in July 2013 with a first class BScHons Economics degree. Currently living in London, she is a second year analyst at the investment banking firm Morgan Stanley, working within equity derivatives.

References

Adler, T. and M. Kritzman (2008), 'The Cost of Socially Responsible Investing', Journal of Portfolio Management, 35 (1), 52–56

Agresti, A. (2012), Illuminate, New York: Houghton Mifflin Harcourt

Akerlof, G. (1980), 'A theory of social custom, of which unemployment may be one consequence', Quarterly Journal of Economics, 94 (4), 749–75

Allen, G. and R. Gordon (2011), 'The impact of corporate social responsibility on the cost of bank loans', Journal of Banking and Finance, 35 (7), 1794–810

Arrow, K. (1972), 'Models of job discrimination', in Pascal, A. (ed.), Racial Discrimination in Economic Life, Lexington, MA: Lexington Books, pp. 83–102

Becker, G. (1957), The Economics of Discrimination, Chicago: University of Chicago Press

Bloomberg website (2012), 'World Stock Indexes', available at http://www.bloomberg.com/markets/stocks/world-indexes, accessed 6 December 2012

Borzykowski, B. (2012), 'Investing in Sin Stocks', Canada Business, available at http://www.canadabusiness.com, accessed 6 December 2012

Brown, A, (2012), 'Guns, Booze and Gambling: Sin Stocks for a Recession-Proof Portfolio', Forbes, available at http://www.forbes.com, accessed 6 December 2012

Burke, M. and P. Young (2011), 'Social Norms', in Benhabib, J., A. Bisin and M. Jackson (eds), Handbook of Social Economics, Amsterdam: North-Holland, pp. 311–38

Capelle-Blancard, G. and S. Monjon (2012), 'The Performance of Social Responsible Funds: Does the Screening Matter?', Working Papers 2011–12, CEPII Research Centre

Chaudhury, M. (2011), 'The Financial Crisis and the Behaviour of Stock Prices', Open Access Publications from Desautels Faculty of Management, McGill University

Derwall, J., K. Koedijk and J. Ter Horst (2011), 'A tale of values-driven and profit-seeking investors', Journal of Banking and Finance, 35 (8), 2137–47

El Ghoul, S., O. Guedhami, C. Kwok and D. Mishra (2011), 'Does Corporate Social Responsibility Affect the Cost of Capital?', Journal of Banking and Finance, 35 (9), 2388–406

Elster, J. (1989), 'Social Norms and Economic Theory', Journal of Economic Perspectives, 3 (4), 99–117

Fabozzi, F., K. Ma and B. Oliphant (2008), 'Sin Stock Returns', Journal of Portfolio Management, 35 (1), 82–94

Gambetta, D. (1987), Were They Pushed or Did They Jump? Individual Decision Making, Cambridge: Cambridge University Press

Harris, D. (2012), 'Vice Fund Backer Says So-Called Sin Stocks Beat Market', ABC News, available at http://www.abcnews.go.com, accessed 13 March 2013

Kacperczyk, M. and H. Hong (2009), 'The Price of Sin: The Effects of Social Norms on Markets', Journal of Financial Economics, 93 (1), 15–36

Kahneman, D. (2002), 'Maps of bounded rationality: A perspective on intuitive judgment and choice', Nobel Prize lecture, 8th December 2002

Kahneman, D., J. Knetsch and R. Thaler (1986), 'Fairness as a Constant on Profit Seeking Entitlements in the Market', American Economic Association, 76 (4), 728–41

Kim, I. and M. Venkatachalam (2011), 'Are Sin Stocks Paying the Price for Accounting Sins?', Journal of Accounting, Auditing & Finance, 26 (2), 415–42

Liu, Y., H. Lu and K. Veenstra (2011), 'Is Sin Always a Sin? The Interaction Effect of Social Norms and Financial Incentives on Market Participants' Behavior', Research Collection School of Accountancy (Open Access), paper 883

McKinsey & Company (2011), Mapping Global Capital Markets 2011, Chicago: McKinsey Global Institute

Micro, T. and V. Michael (2012), 'Social Incentives Matter: Evidence from an Online Real Efforts Experiment', IZA Discussion Papers 6716, Institute for the Study of Labor (IZA)

Perales, F. (2013), 'MUNDLAK: Stata module to estimate random-effects regressions adding group-means of independent variables to the model', available at www.ideas.repec.org, accessed 13 March 2013

Popper, N. (2012), 'Stock Trade is Still Falling After '08 Crisis', The New York Times, available at http://www.nytimes.com, accessed 7 January 2013

Renneborg, L., J. Horst and C. Zhang (2007), 'The Price of Ethics: Evidence from Socially Responsible Mutual Funds', Discussion Paper 2007–29, Tilburg University, Center for Economic Research

Romer, D. (1984), 'The Theory of Social Custom: A Modification and Some Extensions', The Quarterly Journal of Economics, 99 (4), 717–27

Salaber, J. (2007), 'The Determinants of Sin Stock Returns: Evidence on the European Market', Open Access Publications from Université Paris-Dauphine, Paris: Université Paris-Dauphine

Senbet, M. and A. Gande (2009), 'Financial Crisis and Stock Markets: Issues, Impact and Policies', paper presented at the annual conference of the Dubai Economic Council, Financial Crisis, Its Causes, Implications, and Policy Responses, Dubai, October 2009

Sizemore, C. (2012), 'Not all sin stocks are created equal', Market Watch: The Wall Street Journal, available at http://www.marketwatch.com, accessed 13 March 2013

Forum for Sustainable and Responsible Investment (2010), 2010 Report on Sustainable and Responsible Investing Trends in the United States, Washington, DC: US SIF

Statman, M., K. Fisher and D. Anginer (2008), 'Affect in a Behavioural Asset Pricing Model', SSRN working paper series, available at http://ssrn.com/abstract=1094070, accessed 13 March 2013

Statman, M. and D. Glushkov (2008), 'The Wages of Social Responsibility', SSRN working paper series, available at http://ssrn.com/abstract=1372848, accessed 18 November 2012

Steen, A. (2012), 'Investments: Stretching Morals With Sin Stocks', FT Adviser , available at http://www.ftadviser.com, accessed 13 March 2013

Zajonc, R. (1980), 'Feeling and thinking: Preferences need no inferences', American Psychologist, 35 (2), 151–75

To cite this paper please use the following details: Brown, M. (2015), 'Social Norms and Equity Investment Behaviour During the Financial Crisis: An Investigation into the Effects of Social Norms upon Stock Markets and the Impact of the Financial Crisis', Reinvention: an International Journal of Undergraduate Research, Volume 8, Issue 1, http://www.warwick.ac.uk/reinventionjournal/issues/volume8issue1/brown Date accessed [insert date]. If you cite this article or use it in any teaching or other related activities please let us know by e-mailing us at Reinventionjournal at warwick dot ac dot uk.