Map the gap – quantifying the circularity of the UK lithium-ion battery sector to 2050

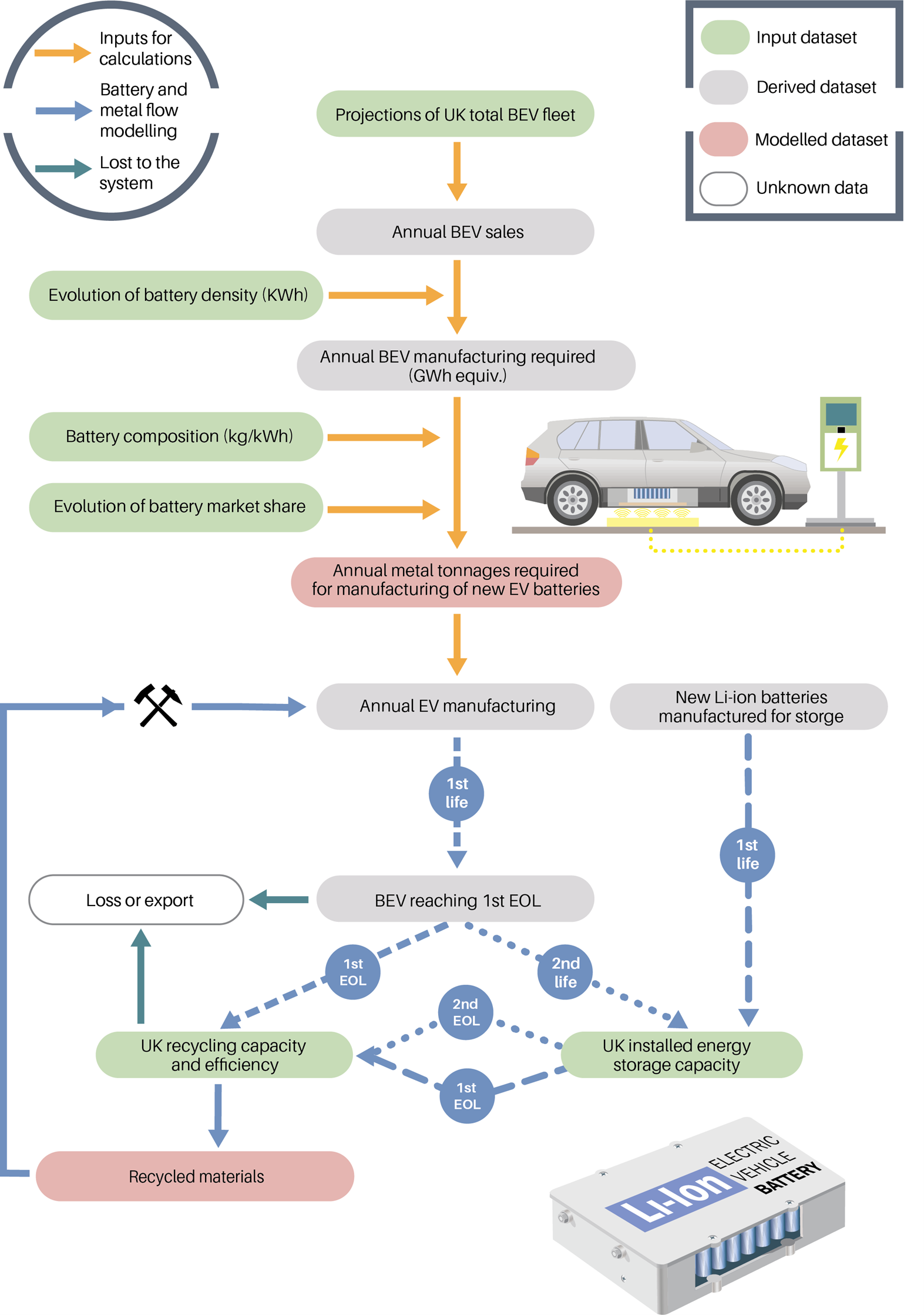

This project is the first to model stocks and flows of recycled materials from the UK BEV fleet and major secondary storage applications, and consider its potential contribution to meeting raw material demand for domestic battery manufacturing.

Links

"Map the gap – quantifying the circularity of the UK lithium-ion battery sector to 2050" Full reportLink opens in a new window

Executive Summary

- In 2022 UK battery electric vehicle production will demand < 1 per cent of total global production of cathode materials. Based on projected market growth by 2032 the UK will consume the following proportions of global production (relative to 2020 production levels): 4–9 per cent of nickel, 20–55 per cent of lithium and 12–37 per cent for cobalt.

- Based on current projected infrastructure development, even in the longer-term the UK will not have the recycling capacity for the quantity of batteries that are expected to reach their end-of-life. In order to comply with future mandated requirements for minimum levels of recycled content in batteries entering the EU market, the UK will either have to import recycled metals for domestic battery production or ensure significant expansion of its battery recycling capacity.

Key Findings

1) All BEV fleet scenarios result in two peaks in battery raw material demand. All the scenarios result in similar levels of total material demand but at different times, owing to variation in BEV uptake rate, fleet saturation and BEV renewal rate across the scenarios.

Notwithstanding the significant uncertainty in the modelling, the trend towards lower Co content in NMC batteries, the potential for the emergence of new disruptive technologies and major breakthroughs in LFP and Li-Air/S batteries in the coming decades; projected UK demand for cathode materials in 2022 increases from < 1 per cent of 2020 global metal production to 4–9% for Ni, 20–55% for Li, and 12–37% for Co in 2031, as a percentage of 2020 world production, highlighting the major increase in primary raw material production that is required to underpin the clean energy transition.

2) By 2033, batteries reaching their first end-of-life (EOL) in EV will vastly exceed annual requirements for secondary applications (e.g. grid storage), and overwhelm projected domestic recycling capacity. The amount of secondary metal available is primarily limited by the recycling capacity in the UK, with very little limited influence from other variables considered in the scenarios before 2040 (Supplementary information). Based on current estimates of demand from secondary applications and the recycling capacity that will exist in the UK, after 2040, only 10 per cent of batteries reaching their first EOL in EV will transition to the secondary market or be recycled. The rest will have to be stored or exported.

Project Team

|

Pierre Josso (PI – early career researcher): Minerals Geoscientist, BGS Eimear Deady (early career researcher): Minerals Geoscientist, BGS Hannah Grant (early career researcher): Marine Geoscientist, BGS Paul Lusty: Principal Economic Geologist and BGS Critical Raw Materials Topic Lead, BGS |