Article 6

by Anant Sudarshan

Achieving large-scale economic growth against the backdrop of the climate crisis is a huge challenge for India. Emissions trading could be a solution.

No country in history has significantly increased incomes without also consuming more energy. Right now, India uses less than a quarter of the energy of the United Kingdom, on a per capita basis. This will surely rise significantly, and it is hard to believe that it will happen without burning more fossil fuels.

The Indian government’s top policy think-tank, the NITI Aayog, has developed a set of energy growth scenarios: Of these, the most aggressive renewable energy scenario forecasts almost a doubling of coal-based energy by 2047.

This is a thorny policy challenge because the environmental costs of this energy undercut its promise of prosperity. These costs include damages from both local air pollution and carbon emissions.

In India, 1.3 billion people now breathe air that is more polluted than World Health Organisation guidelines. Data from the Air Quality Life Index indicates that fine particulate pollution is now reducing life-expectancy by about 5 years on average, far more than malnutrition (1.8 years) or smoking (1.5 years).

In terms of CO2 emissions, India is already the world’s third largest emitter, and highly vulnerable to the effects of climate change. Research suggests that under an RCP 8.5 warming scenario, death rates in India will increase by 0.60 per 1000 in 2099 – roughly 1.5 million excess deaths per year (Carleton et al., 2022). These environmental damages are not decreasing. Levels of air pollution have increased by over 60% since 1998 (AQLI 2022). At current rates of growth, the country is likely to fall short of its own CO2 emissions targets.

Can India take control its emissions and achieve economic growth?

The role of regulatory innovation

India’s environmental record reflects – at least in part – severe weaknesses in the regulatory framework used to manage industrial pollution and fuel choices. Over 97% of coal in the country is burned in factories and power plants. Yet many plants remain out of compliance with pollution standards and direct regulation for CO2 is practically non-existent.

India needs a solution to effectively control emissions, in a setting where state capacity is limited and reducing the costs of regulation is of the utmost importance. One possibility is the use of market-based instruments, such as cap-and-trade regimes.

Under this system the government sets a limit on the total pollution that a population of regulated plants can emit in a specified period (typically several months or a year). This total is what matters for health or climate benefits. Meanwhile plants can apportion this total amongst themselves by buying and selling permits. This flexibility reduces costs for firms and distinguishes markets from conventional command-and-control mandates that specify hard limits for every plant.

Yet while cap-and-trade markets have been successfully adopted in the United States and the European Union, they are not widely used in developing countries, where less costly regulation may be attractive. My coauthors and I evaluated a new emissions market in India: the first cap-and-trade scheme in India and the first in the world to regulate particulate emissions. This project is also the first time a randomised control trial has been used to measure the impacts of emissions trading.

The Emissions Trading Scheme (ETS) was implemented amongst 342 highly polluting plants in the industrial city of Surat. Half were randomly chosen to be shifted to the new market-based regulation. The other half were regulated as before.

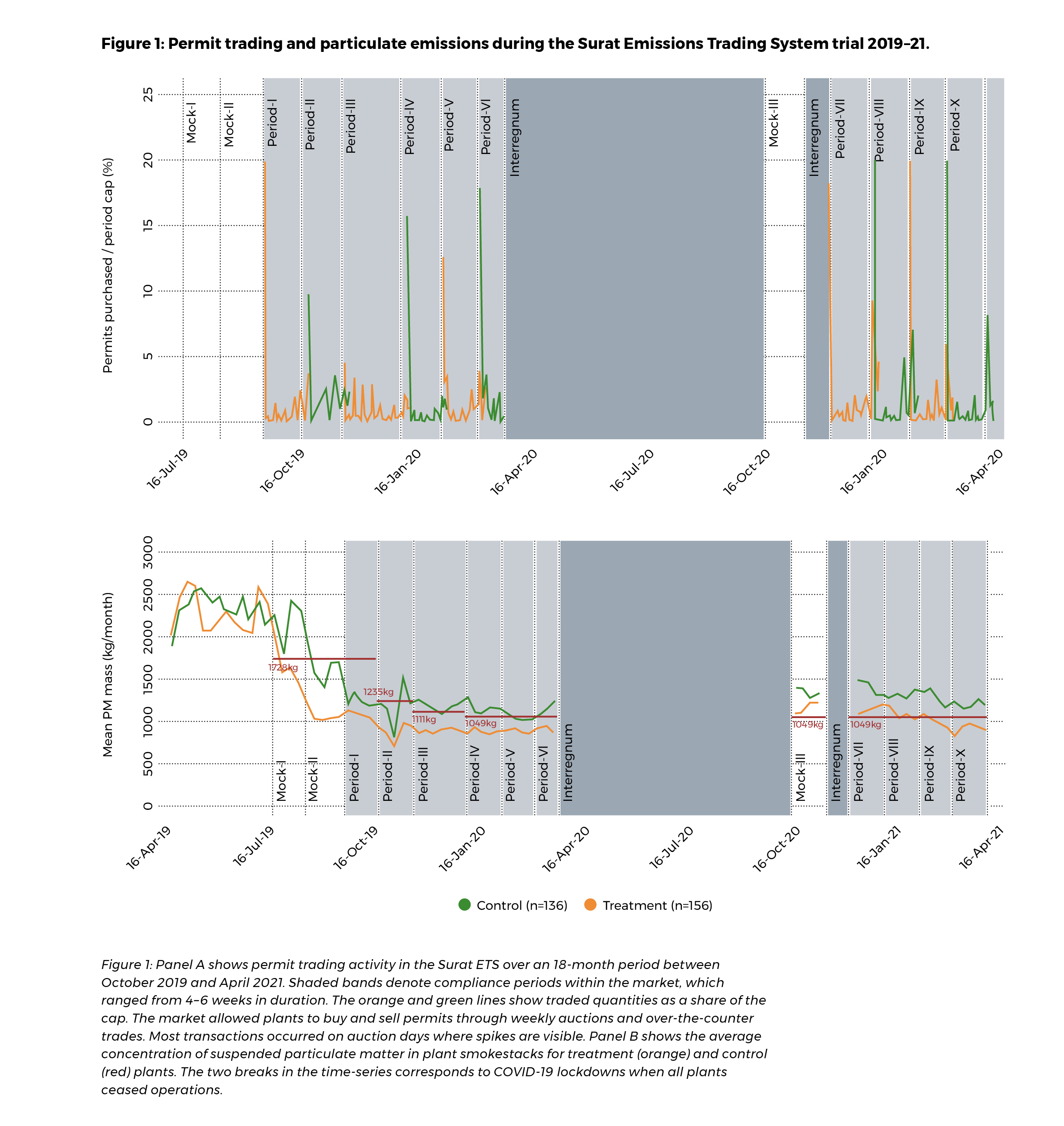

We document three main findings. First, the market worked well: permit trade was active, and plants obtained permits to meet their obligations almost perfectly. This is not a trivial outcome because compliance with traditional regulation is extremely poor in India. Panel A of Figure 1 shows permit trading activity over a one-year period of the market. A meaningful share of the cap is traded every period (spikes in trading activity are on days when auctions were held).

Second, treatment plants (those randomly assigned to the emissions market) reduced particulate matter emissions by about 20%, relative to control plants. Panel B of Figure 1 plots pollution measured by continuous emission monitoring system (CEMS) for plants that were in the market, compared to those that were not. The two lines overlap before the market starts since treatment and control groups were statistically identical by construction. They diverge after the market kicks-off, with treatment plants producing lower pollution.

Third, we find no evidence of increased abatement costs (costs of reducing emissions) for plants in the market, even though pollution was reduced. As a result, the pollution market turns out to be highly cost effective. We estimate that health benefits exceed costs by at least 25 times.

The evidence from this experiment suggests a previously underappreciated benefit of emissions markets in developing country contexts. Textbook economics tells us that market-based regulation may be cheaper. The experience from India suggests another advantage – it may also be more feasible to implement markets, especially in settings where state capacity is low and legal enforcement of inflexible mandates is difficult.

Markets and low-carbon growth

Are markets also a pathway to low-carbon growth?

The most concrete example of carbon markets in the developing world comes from China, where a national market is being created from local sector-specific markets. The scale of the China ETS is sweeping – covering over 2000 emitters and 40% of energy related carbon emissions. These markets differ from the EU ETS or indeed our Surat experiment. Instead of setting limits on total emissions, they are designed to reduce emissions intensities – carbon per unit of output – reflecting China’s desires to grow its economy as rapidly as possible, while transitioning to a greener trajectory.

The EU and China present two different models, but both are linked by an emphasis on markets as the centrepiece of climate policy. Towards the end of 2022, India passed new legislation enabling the introduction of markets in CO2. The country is still working on what these might look like but may well come up with a new design of its own.

Overall, the results from the Surat experiment suggest that developing countries can achieve greener growth by changing the incentives that polluters face. When we think about what innovation means in the context of climate policy; new regulation might be just as important as new technology.

About the author

Anant Sudarshan is Associate Professor of Economics at the University of Warwick and a CAGE Associate.

Publication details

Greenstone, M., Pande, R., Sudarshan, A. and Ryan, N. (2023). Can pollution markets work in developing countries? Experimental evidence from India. Warwick economics research papers series (no. 1453).