Risky Debts

University is often your first opportunity to borrow money. Keep reading to understand the risks of borrowing, including which debts are riskier than others, and the ones best avoided altogether.

Understanding Credit

So what is credit?

Credit is any product that allows you to borrow money. It includes things like mortgages, bank loans and credit cards, which most people think of when you talk about borrowing money, but also payday loans, buy now pay later services like Klarna, and car financing offered by your dealership.

Any credit product will make a mark on your credit history, showing when you paid on time, when you didn’t, how much you owe, and even any credit applications you have made, whether they were successful or not. All of this information is used to give you a credit score, that essentially tells lenders how much of a risk you would be to lend to.

If you have a good credit score it can make it easier to take out credit products and can even improve the rates you are offered. This means that you could be allowed to borrow larger amounts or be charged less interest. However a bad credit rating means that you could be charged more interest for the same product, or even have your application refused altogether.

That doesn’t mean you should avoid credit entirely, however, as not borrowing at all can also mean a low credit score. Remember, your credit score is an indication of risk for any lenders, and they can't tell how much of a risk you are if you have no history for them to go off.

Using things like credit cards for purchases can also offer you greater protection. Section 75 of the Consumer Credit Act means that if you pay for something over £100, the lender is equally liable if something goes wrong. This means that you can claim the money back from your credit card company, and then they can chase the company for a refund, instead of you having to try and do it yourself.

Learning to use credit responsibly then, is an important step towards taking out large credit products, such as a mortgage, later in life. Start small. Pay for a few normal monthly expenses on a credit card, and set it up to pay off in full automatically from your bank account. You'll soon see your credit score increase, and you will be on your way to being financially responsible after university.

For more details on how to boost your credit score, check out this great guide to understanding credit from Martin Lewis.

Short-Term Borrowing

It can be incredibly tempting, but it is important not to borrow money to maintain a lifestyle you can afford.

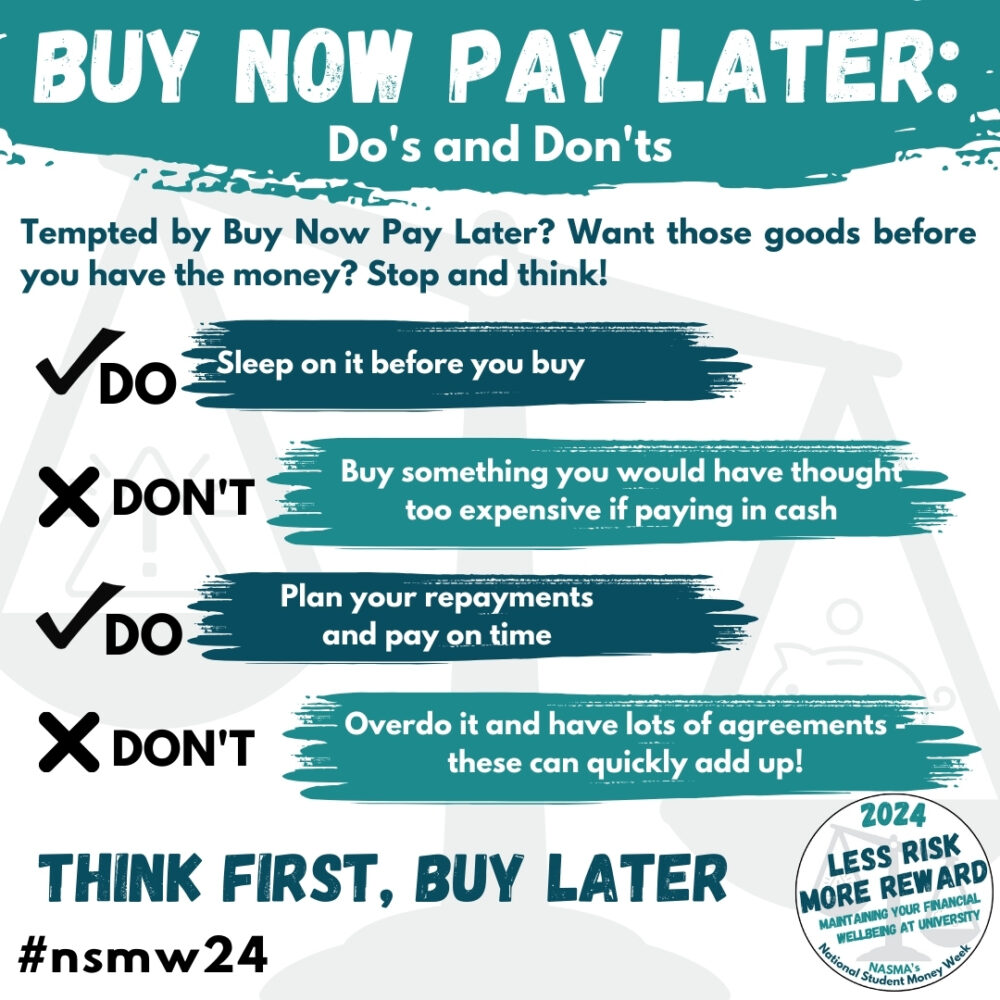

Buy now pay later systems like Klarna or Monzos "flex" service make it easier than ever to spread the cost and help to get those more expensive items today. But if something goes wrong and you turn out unable to make those 3 months of easy payments, you can end up with interest added to what you owe (19% APR for Monzo), negative impacts on your credit score, or even your debt being sold to a debt collection agency.

These services can be a brilliant lifeline to help you afford essential living costs when things get tight, but relying on them for everyday purchases like takaways, can cause your debt to spiral out of control.

Before you use any buy now pay later services, read this great article from Save the Student on Klarna or this Buy Now Pay Later Article from Money Saving Expert, that explains the risks.

Problem Debts

An out-of-control debt is stressful for anyone, but burying your head in the sand is not going to help, and could cause the situation to worsen. The sooner you can confront the reality of your debt, then the sooner you can start working towards being debt-free.

There are charities that can help, including Citizens Advice, StepChange Debt Charity, and National Debtline.

Or check out these online resources that can help you work towards being debt-free:

Illegal Lending

All money lenders, including banks, have to be authorised by the Financial Conduct Authority, to ensure they are abiding by the law in their lending practices. However, this doesn’t stop others from operating illegally as a money lender. These people are known as loan sharks and have been known to target students due to their inexperience in borrowing money.

Loan sharks often work from home or online, unlike a bank where you can visit in person to see that it's real. They will also often charge very high rates of interest, give very little paperwork, and not carry out any credit checks.

Loan sharks will also often resort to other illegal behaviours to collect the money they are owed, such as violence or theft. In extreme cases, they have even been known to force people into drug dealing or prostitution to pay back their debt.

But it is important to remember that these lenders are acting illegally, and help is available. Contact Stop Loan Sharks on 0300 555 2222 to safely report a loan shark, or visit the Stop Loan Sharks website for more information.

Long-Term Impact of Issues

What starts out as a small payday loan can have devastating long-term consequences if you allow interest and debt to spiral out of control. This 1st hand account from Save the Student shows just how quickly things can get out of control.

However, even once your debt has been cleared it can impact your credit score for years to come. This is because your credit score is used as a predictor of future behaviour, essentially a risk score for banks to see if you would be a good bet to lend money to. Every missed payment can impact your score as it makes you a worse bet for the banks to get their money back, as well as increasing the interest and amount you now owe. This can have a big impact on what you can afford once you leave university, as not only will they check your credit history for loans such as buying a car or a mortgage, but can also factor into renting checks.

With time and work, your credit score can recover. But in the meantime, you could be stuck paying more interest on loan or credit card repayments, or unable to take out credit at all

For more information, see this great guide to credit scores from Martin Lewis.

The Student Funding Support Team is here to help. Contact us by email (studentfunding@warwick.ac.ukLink opens in a new window), phone (024 7615 0096), or in person at the Wellbeing Reception in Senate House (10am-3pm Monday-Friday).