Cleaning up our own mess - Dr Arun Advani comments on Commons debate on beneficial ownership in the UK’s Overseas Territories and Crown Dependencies.

Cleaning up our own mess - Dr Arun Advani comments on Commons debate on beneficial ownership in the UK’s Overseas Territories and Crown Dependencies.

Thursday 7 Dec 2023Cleaning up our own mess

Arun Advani, Cesar Poux, Andy Summers

Today the House of Commons will debate “the implementation of public registers of beneficial ownership in the UK’s Overseas Territories and Crown Dependencies”. While this sounds dry and technical, it is vitally important if we are to clean up the ownership of UK land. The core issue is that while the ownership of most UK land is publicly reported by the land registry, currently there are many ways to avoid this if you have enough money.

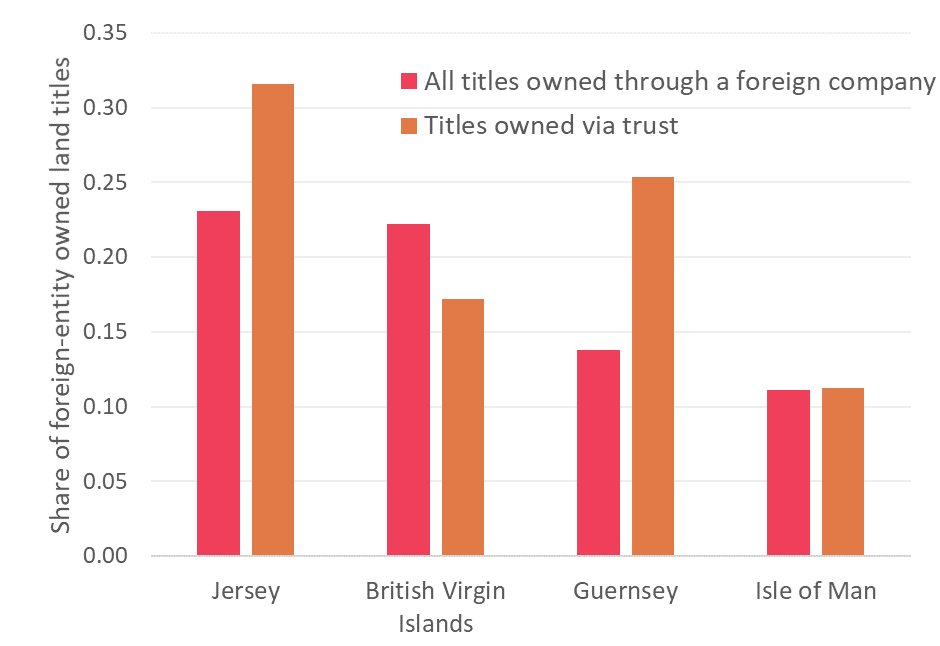

One of the most common ways is to own UK land through a foreign company in a jurisdiction where information about who owns that company is not public. Tens of billions of pounds worth of UK land is owned through a foreign company, and more than 70% of this is owned via companies in the three Crown Dependencies – Jersey (23%), Guernsey (14%), the Isle of Man (11%) – plus one of the Overseas Territories, the British Virgin Islands (22%).

Figure 1: Share of UK land titles owned by foreign companies, by country of foreign company

Recent reforms to the reporting of UK land ownership introduced a Register of Overseas Entities, which in principle requires the beneficial owner – an actual person – to be reported in the UK, where the direct owner is an overseas company. However, the register is riddled with holes.

One such hole, which accounts for 63% of cases where beneficial ownership information is not publicly reported, is the use of trusts. Trust arrangements allow someone to benefit from the assets owned by a company without themselves being the owner of the company. The Crown Dependencies and Overseas Territories are again heavily implicated here. Over 85% of all trust arrangements come from the top four: Jersey (32%), Guernsey (25%), British Virgin Islands (17%) and Isle of Man (11%). While the UK register could have been designed better, its operation is not helped by the lack of transparency in the Crown Dependencies and Overseas Territories.

Beneficial ownership registers of companies would have wider benefits beyond UK land. They would ensure ownership of other assets, such as private jets and ships were more transparent. The two years following the Russian attack on Ukraine have made it very plain: without beneficial ownership registers, comprehensively enforcing sanctions is impossible.

Creating a company in the UK comes with legal obligations that include making beneficial ownership known. It is right for the UK to insist that these standards are applied in the Crown Dependencies and Overseas Territories as well, to avoid undermining our own regime.