by Arun Advani, David Burgherr and Andy Summers

A colonial-era tax perk allows some UK residents to go untaxed on overseas investments, just by declaring that their permanent home is abroad. These ‘non-doms’ save an average of £126,000 each, every year, through use of the remittance basis. Scrapping this regime would raise some much-needed cash, without leading to substantial emigration.

In 1799, William Pitt the Younger introduced Britain’s first Income Tax, to raise revenue for the war against Napoleon. Back then, Britain was in its colonial heyday, and many people made or maintained their fortunes through foreign investments. Income from these investments was not taxable until the money was ‘remitted’ i.e. brought onshore. This was a predominantly practical measure, as income from foreign investments was earned almost entirely from trade in agricultural goods, and these products had to be brought onshore before further trading. For most people then, taxing on this ‘remittance basis’ was merely a deferral of tax.

As so often with taxes, this reasonable-sounding arrangement came to be abused. Those making foreign investments learned to keep them offshore to avoid tax altogether.

Conscious of the money lost to the exchequer, in 1914 Chancellor David Lloyd George planned to tax ‘income that escapes taxation now owing to arrangements purposely made by men who are rich enough to leave their incomes abroad’. But at a time when ‘citizens of empire’ were increasingly passing through the UK, but not staying permanently, the remittance basis was kept for people whose permanent home was elsewhere: the ‘non-doms’.

And so, more than century later, the remittance basis lives on anachronistically in a corner of the UK tax system, for those who are foreign-born or have a foreign father (or mother where parents were unmarried). Once a decade we witness some scandal, and small reforms, but the essential structure has remained.

Proponents often justify the existence of the remittance basis as a way to encourage people to come to and invest in the UK, although its design does rather the opposite: requiring people to keep their investments, and their long-term home, abroad if they wish to benefit. Opponents decry the regime as fundamentally unfair in principle: that despite living and working together, some pay a different tax rate to others.

The principal barrier to reform has been a lack of information. Little was known about who benefits from the remittance basis. And nothing at all was known about the revenue that could be raised if it were abolished, since offshore income benefitting from the remittance basis is not even reported to the tax authority.

Using access to confidential, anonymised data from HMRC, we show that the non-dom regime has benefitted far more people than previously thought. Almost half a million people used this status for tax purposes between 1997 and 2018, around 1% of UK adults and equivalent to the population of Manchester.

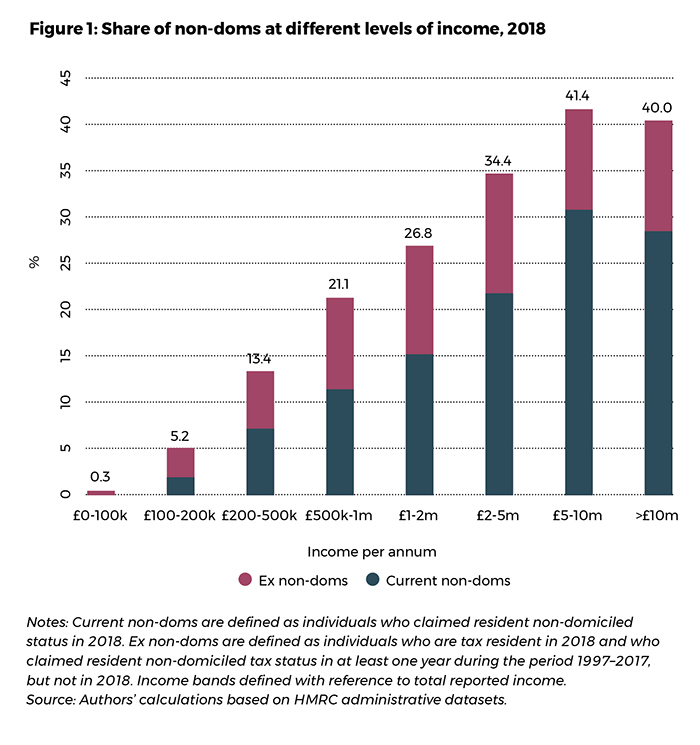

This status has been particularly used by the rich (Figure 1). Only 3 in 1000 people with onshore incomes below £100,000 have ever used the status. But among those with onshore incomes above £5 million, more than two in five have used it. It is also concentrated in particular industries, with more than one in five top-earning bankers making use of non-dom status.

Given the concentration of non-dom status among those with high onshore incomes, it is likely that the offshore income for this group is substantial, and therefore significant tax is being foregone through the remittance basis rule.

By statistically comparing non-doms to people who are domiciled in the UK (most ordinary taxpayers) and who look most like them in terms of key observable characteristics, we can estimate this unreported offshore income.

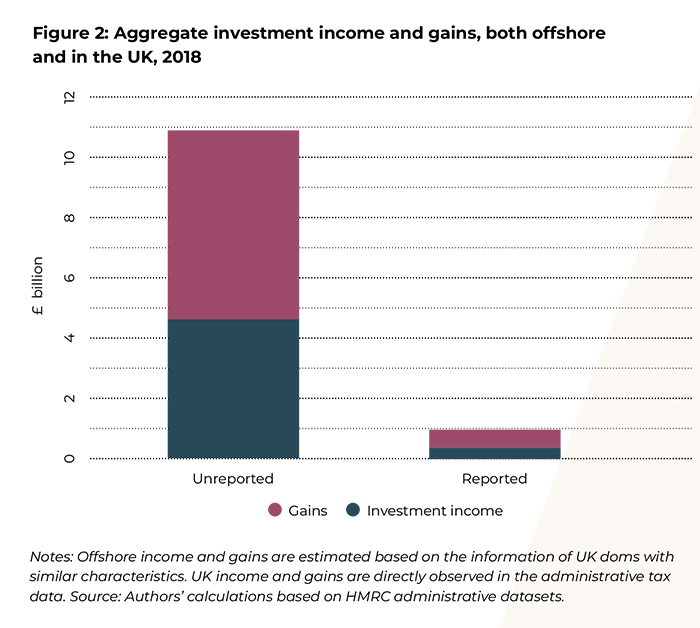

Collectively, non-doms had at least £10.9 billion in offshore income and capital gains in 2018, or £420,000 each on average.

These offshore returns were as much as the combined income of the poorest fifth of UK adults in the same year. It is also much larger than their onshore investment (Fig 2), highlighting the perverse effect of the current regime in driving investment offshore.

One concern might be that taxing income on foreign investments would lead the non-doms to leave, since they necessarily have some foreign connection. This would deprive the exchequer of not only the planned new revenue, but also the existing tax non-doms pay. However, evidence from past reforms of the remittance basis shows us that very few non-doms left the country, and the very few who did leave were paying hardly any tax.

The net effect of abolition of the regime would therefore be to raise a further £3.2bn in tax for the UK.

Abolition of the remittance basis would also make the regime fairer. More than 200 years since it was introduced, the remittance basis now provides arbitrary and unjustified tax breaks to a small group of wealthy individuals, merely based on an accident of birth or parentage. This has no place in a modern tax system, and should be scrapped.

About the authors

Arun Advani is Associate Professor of Economics at the University of Warwick and a CAGE Associate.

David Burgherr is Research Assistant at the International Inequalities Institute at the London School of Economics.

Andy Summers is Associate Professor of Law at the London School of Economics and a CAGE Associate.

Note: This work contains statistical data from HM Revenue and Customs (HMRC) which are Crown Copyright. The research data sets used may not exactly reproduce HMRC aggregates. The use of HMRC statistical data in this work does not imply the endorsement of HMRC in relation to the interpretation or analysis of the information.

Related publications

Advani, A., Burgherr, D., Savage, M., and Summers A. (2022a). The UK's global economic elite: A sociological analysis using tax data. CAGE working paper (no. 570).

Advani, A., Burgherr, D., and Summers A. (2022b). Reforming the non-dom regime: revenue estimates. CAGE Policy Briefing (no.38).

Advani, A., Burgherr, D. and Summers, A. (2022c). Taxation and migration by the super-rich. CAGE working paper (no. 630).