Fiscal rules

Fiscal rules

The Politics of Fiscal Rules

The political settlement underpinning the late 20th Century and early 21st Century foregrounded the role of fiscal rules a means to secure budgetary discipline. Governments introduced fiscal policy rules, and independent oversight bodies, in an effort to reassure electorates and financial markets that they were sound custodians of the public finances.

Rules-based economic policy is designed to limit the discretionary actions of policy-makers. These technocratic economic policy-making regimes assumed that the administration of economic policy by independent experts could be relied upon to restrain governments.

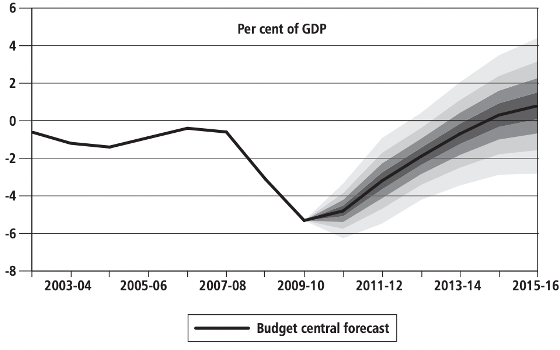

These rules might take the form of simple targets for the desirable level of public debt or deficit, often expressed as a percentage of an economy’s GDP. While nominal fiscal rules have the advantage of being transparent and easy to understand, they are insensitive to the economic cycle and can lead to potentially damaging policies, such as government spending cuts during a recession.

Cyclically adjusted fiscal rules are designed to sensitive to its position in the economic cycle. The ideas is to improve upon the blunt instrument of nominal fiscal rules, which can create suboptimal policy outcomes (see below). Cyclically adjusted fiscal rules face their own challenges, however, particularly in accurately determining the shape of the economic cycle and the position of an economy within it.

Although fiscal rules are often assumed to tie governments to the mast of fiscal rectitude, they are not unchanging or inviolable. Far from economic policy rules being set in stone, fiscal regimes can and do change to become more or less forgiving of higher debt and deficit levels, for example.

Often key economic concepts and categories needed to put fiscal rules into practice are non-observable and cannot be directly measured. Thus the economic concepts used to frame and pilot economic policy, and enact fiscal rules, are always political and social constructs.