Understanding your Payslip

Payslip Notification

Subscribe to be notified each month when your payslip is available to view on SuccessFactors (SF),

Please note: this service is for active individuals in SF including salaried and GTA employees, STP and VAM workers.

Excluding: Unitemps, PSCs, PAS Workers.

How to access your Payslip

In SuccessFactors click on "My Profile" on your homepage; you will see a tab called "payslips" where there is a list of available payslips, click on the link and your payslip will open as a pdf document. If you hold more than one assignment in SuccessFactors, your payslip information will only be visible on your primary assignment.

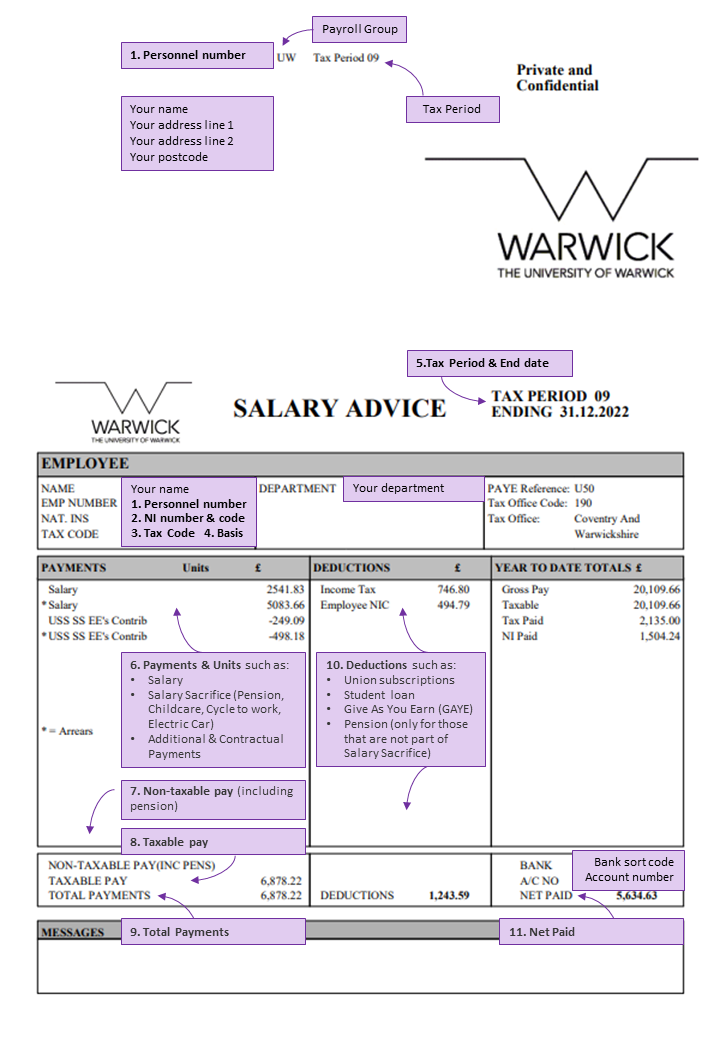

How to read your payslip

Your payslip holds all the important information that you will need to know. We have provided an annotated example of a payslip below to help you to understand your payslip. The reference numbers link to the explanation given under the heading payslip terms.

You may notice that some terms have been altered on the payslip descriptions. Below is a table explaining a few of the most common changes that you may see:

| Old Description |

New Descriptor |

| Bonus |

Commercial Bonus |

| Busy Bees Scheme - SS |

Computershare SS |

| Busy Bees Scheme SS - Pen'ble |

|

| KIT Day |

KIT/SPLiT Day |

| Net Overpay Recovery |

Debt Recovery |

| University ShPP |

Enhanced Parental Pay |

| Stat Maternity Pay |

Maternity Pay |

| Stat Mat Pay Offset |

|

| Univ Maternity Pay |

|

| Statutory Adoptn Pay |

Adoption Pay |

| Stat Adop Pay - Offset |

|

| Univ Adoption Pay |

|

| ShPP |

Shared Parental Leave |

| University ShPP |

|

| Sick pay is now displayed as separate figure for full or half pay. Previously it was within salary figure. |

Sick |

Payslip terms

1. Personnel number: If you have more than one contract you may have several personnel numbers. Your payslip will only display your personnel number from your primary contract.

2. NAT. INS: If you have a National Insurance number (NI) it will be displayed here. Everyone will have a NI category code usually an A, but C if you are over the age of retirement.

3. Tax code: Common codes include 1257L (Standard tax code which corresponds to an annual tax allowance of £12,570). Your code may be slightly different if you have allowances or additional taxable earnings. BR If you have another source of income or if you've started with us and don't have a P45 and haven't yet completed a P46. This means that all your taxable pay will be taxed at 20%. 0T If your allowances have been used up or reduced to nil, your income will be taxed at the relevant rate (20%, 40% or 45%). If you think your tax code is wrong, you must inform HMRCLink opens in a new window directly.

4. Basis: There are two bases: Cumulative (C) your earnings to date are compared to your tax allowance to date and Week one/Month one (W1/M1) you are taxed on your taxable earnings in that month only.

5. Tax Period & "Ending": The tax year runs from April to March (tax period 1 to 12). Ending refers to the last day in the month in which you are being paid. Even though the University pays employees on its main payroll on 24th of the month, your pay is for the whole calendar month.

6. Payments & Units: Your salary figure should equate to 1/12 of your annual salary (before any salary sacrifice arrangements). Note that if you are in any salary sacrifice schemes such as for pension, childcare or cycle to work, you will see a negative figure here. Units will display total hours worked for certain payments such as overtime. Where there are arrears (*) this is a reference to a previous month's adjustment.

7. Non-taxable pay (inc pens): Items such as pension contributions including 'Additional Voluntary Contributions payments' (AVC) and 'Give as you Earn' (GAYE) contributions are deducted from your pay when calculating how much is taxable.

8. Taxable pay: This is a total of your payments less any salary sacrifice deductions, pension (including AVC) payments & GAYE.

9. Total payments: Total payments is the sum of non-taxable pay and taxable pay (7 plus 8).

10.Deductions: These include tax and national insurance (NI). If you have Union Subscriptions, Student Loan, GAYE these will appear here. If you are in a non-salary sacrifice pension, you will see your pension contributions as a deduction. Underneath this column is the total sum of deductions in the month.

11.Net Paid: Total payments less the total deductions. The amount paid to your bank account.

NOTE:

Please download and save a copy of your P60 and payslips for your own personal records. HMRC recommends storing financial documents for 7 years minimum.

If you leave the University you will no longer be able to access your SF record.