USS changes update 26 January

Dear colleague

As you may know, employer representatives (Universities UK) and member representatives (UCU) have been meeting as part of the USS Joint Negotiating Committee (JNC) structure to discuss potential changes to future benefits in response to the 2017 USS scheme valuation. Warwick’s Vice-Chancellor, Stuart Croft, has sought to engage with UUK on this. On Tuesday, the JNC met to discuss proposals from both sides. As there was not agreement for a common approach the independent chair used his casting vote – which was in favour of UUK’s position.

As a result of the JNC decision, it is expected that a 60-day employer consultation with staff on the proposals will commence in February 2018. This will enable staff to feed back their views to UUK and USS in order for these views to be considered as part of the final decision on benefit reform. In this context, I want to share more detail on the proposals as we understand them.

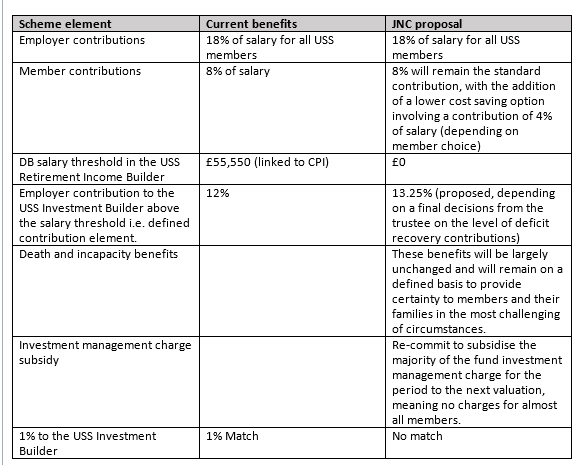

The proposals and background are set out more fully on the USS website but, in brief:

1. If implemented as set out by UUK, the proposals do not impact benefits built to date. They would only affect benefits after the effective date of the changes, which isn’t expected to be before April 2019.

2. The salary threshold (the salary up to which defined benefits currently build up) will reduce to zero, subject to review at future valuations. There would effectively be no defined benefit build up from the USS Retirement Income Builder.

3. UUK is proposing an employer defined contribution of 13.25% (depending on a final decision from USS relating to the level of deficit recovery contributions.)

4. The standard member rate will continue to be 8% of salary, but there is a proposal that members only need to pay 4% in order to obtain the full defined contribution from the employer. Assuming that 13.25% is agreed this means that if an employee pays 8%, the extra 4% from the member is effectively an additional contribution. Of course if you reduce your member contribution to 4% it will mean a lower fund at retirement compared to a member that continued to pay 8%.

5. Death and incapacity benefits will be largely unchanged.

6. The 1% match will be discontinued from the date of the change.

7. Subsidies to the Investment Builder charges will continue.

To help aid comparison between current benefits and those proposed I set out below a table adapted from information provided by UUK. Employers will continue to pay 18% to USS and the excess over the 13.25% is used to fund the deficit recovery contributions, death and incapacity benefits and USS costs that arise in relation to administration and

investments.

So long as the DB salary threshold remains at zero then there would be no further build-up of defined benefits or sometimes referred to as “guaranteed benefits”.

As mentioned earlier, members will be given an opportunity to provide feedback as part of the formal employer consultation in the coming weeks, and we will continue to keep staff informed on developments in the meantime. If you have any queries at this point in time, please don’t hesitate to contact hr dot pensions at warwick dot ac dot uk

Best wishes,