Doctoral Students

Funding Frequently Asked Questions (FAQs):

- How much will my tuition fees be?

- How do I pay my tuition fees?

- What financial help is available?

- How do I apply for a Doctoral loan?

- How much Doctoral Loan am I eligible for?

- How will a Doctoral Loan affect my UK Government Means-tested Benefits?

- How do I repay my Doctoral Loan?

- Am I eligible for Disabled Students Allowance (DSA)?

- Is there any information about managing, making and saving money?

How much will my tuition fees be?

Tuition fees for postgraduate degrees vary based on the level of study and course. For more information, see the following webpage from the University's Student Finance Team:

How do I pay my tuition fees?

You will need to arrange payment of your tuition fees directly with the University. For further details, visit the University's Student Finance Team's Types of Fee, Tuition FeesLink opens in a new window and Making Payments Link opens in a new windowwebpages.

What financial help is available?

You may be eligible for a Doctoral Loan from the UK Government to contribute towards your course, tuition and living costs. Eligibility for a Doctoral Loan will depend on certain criteria, such as your nationality and residency status. You can view the full criteria at:

- Student Finance England - Doctoral Loan Eligibility

- You will not be able to get a Doctoral Loan if you have or will receive Research Council Funding, a Social Work Bursary, or if you are eligible for an NHS Bursary.

If you are unsure whether you qualify for the Doctoral Loan, you can Contact Student Finance EnglandLink opens in a new window directly to clarify.

How do I apply for a Doctoral Loan?

Applications for Master's Loans are made online, see the following webpage for more information:

Points to note when applying:

- You do not need to have a guaranteed place on the course to apply. If your plans change before you are due to start, you can cancel or amend your application.

- You should make your application as early as you can to ensure your assessment is made by the time you start the course.

- You'll only have to apply once, even if your course is longer than one year.

If you can't find your course listed in the Student Finance England application, please contact the University's Student Finance Fees TeamLink opens in a new windowLink opens in a new window.

- Do not submit a Doctoral Loan application to Student Finance England unless you are certain you have selected the correct course.

- Before a loan payment can be released to you the University must confirm that the course information stated on your loan application matches the course information on your Warwick student record. If this can't be done you will not receive any loan payments but will still be required to make tuition fee and accommodation payments.

How much Doctoral Loan am I eligible for?

Your Doctoral Loan will be paid into your bank account in three instalments during the academic year. If you're studying for 2, 3 or 4 academic years, the loan will be divided equally across each year of your course.

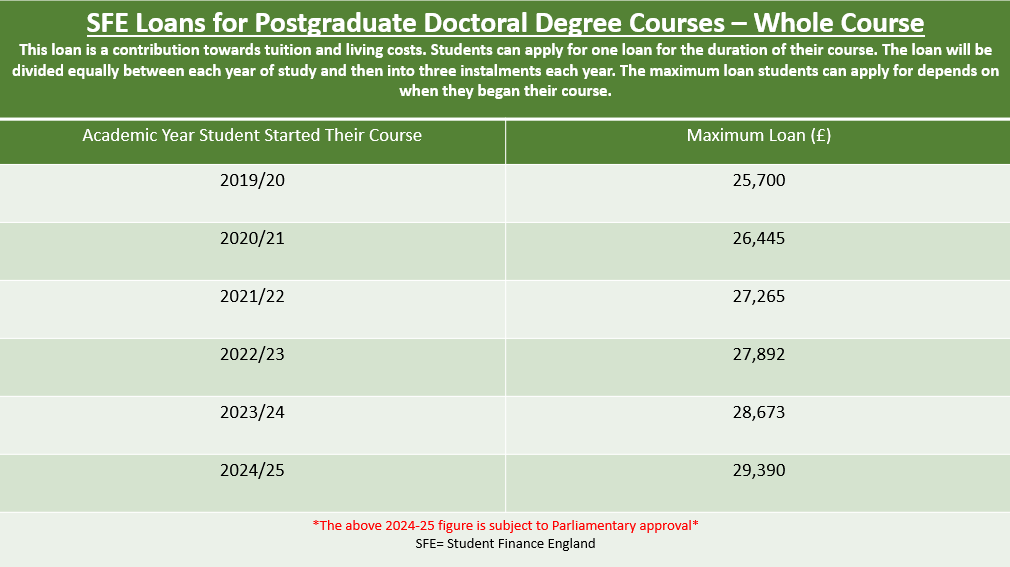

The Doctoral Loan is a contribution towards tuition fees and living costs. Students can apply once for this loan. The amount of loan available to students depends upon their year of entry. The below tables demonstrate the maximum amount of Doctoral Loan available for the entity of a course.

- For example, the maximum amount of Doctoral Loan available to students starting their course in the academic year 2024-25 is £29,390 for the entirety of their course (subject to Parliamentary approval).

How will a Doctoral Loan affect my UK Government Means-Tested Benefits?

Please note, if you receive a Master's or Doctoral Loan, this may have an impact on any means-tested UK Government benefits that you are entitled to. Examples of these include (list not exhaustive):

- Income Support

- Income-based Job Seekers’ Allowance

- Income-related Employment and Support Allowance

- Housing Benefit

- Council Tax Reduction

- Working Tax Credit

- Pension Credit

- Universal Credit

You are advised to contact your local Citizens Advice Centre for more information:

- Coventry Citizens AdviceLink opens in a new window

- South Warwickshire - Leamington Citizens AdviceLink opens in a new window

- South Warwickshire - Warwick Citizens Advice Link opens in a new window

How do I repay my Doctoral Loan?

- Repayments will be based on your income, not what you borrowed.

- Your repayments will start in the first April after you leave your course or the April 4 years after the course started whichever comes first.

- However, no repayments towards Doctoral Loans will be taken until your income is over the current threshold of £404 a week, £1,750 a month or £21,000 a year.

- You’ll repay 6% of what you earn over the threshold. If you already have a Postgraduate Master's Loan then you'll make a combined repayment of 6% covering both postgraduate loans.

- Student loan repayments will be taken even if you don’t earn over £21,000 in a year but exceed the weekly or monthly threshold at any time. For example, if you work overtime or get a bonus.

- Interest is charged from the day the first payment is made until the loan is repaid in full. Interest will be charged at the Retail Price Index (RPI) plus 3%.

- Any loan (and interest) remaining 30 years after you’re due to start making repayments will be written off.

- If you took a loan for your undergraduate course, payments for your postgraduate loan(s) will be made alongside your undergraduate loan repayments. For more information about how your repayments will be calculated visit the following webpage, Repaying Your Student Loan.

Am I eligible for Disabled Students' Allowance (DSA)?

If you have a disability, long-term health condition, mental health condition or specific learning difficulty there is additional non-repayable support available.

- DSA is a non-repayable grant offered by SFE.

- DSA is intended to help with any disability-related costs you might have.

- Any support you receive will be based on your individual needs, not your household income.

- To find out how to apply, check out the following webpage Disabled Students' Allowance - How to Apply.

- For more information on the support provided, the evidence required and how to apply check out SFE's Disabled Students' Allowance webpage and/or the University's Disability Team's Applying for DSALink opens in a new window webpage. Within the University's Disability webpage, you will also find a DSA Eligibility CheckerLink opens in a new window tool which you can use to see whether you may be eligible for DSA.

Is there any information about managing, making and saving money?

If you want to learn more about managing, making, and saving money, check out our Money Matters sub-section.