Graduate Entry Medicine (MBChB) - 2024 Entry

Funding Information:

- Tuition Fees and Financial Support Overview

- Paying Tuition Fees

- Maintenance Loan Entitlement

- Applying to Student Finance England (SFE) for the Tuition Fee, Maintenance Loans and Non-repayable Grants

- Repaying the Tuition Fee and Maintenance Loans

- Applying to the NHS Bursary Scheme

- Maintenance Loan/NHS Bursary and UK Government Means-tested Benefits

- Manging, Making and, Saving Money

This webpage contains funding information for students starting the Graduate Entry Medicine course at Warwick in 2024-25. The information on this webpage only applies to students who are normally resident in England and meet the residency criteria outlined on the Student Finance England - Undergraduate EligibilityLink opens in a new window webpage.

Link opens in aIf you are not ordinarily resident in England and/or you don't meet the residency criteria outlined above, please see our Students Ordinarily Resident Outside of EnglandLink opens in a new window webpage for the information relevant to you.

Tuition Fees and Financial Support Overview

Tuition Fees for the graduate entry Medicine course in 2024-25 are £9,250. The University may increase fees in line with any inflationary uplift as decided by the UK Government in subsequent years of your course. It is expected that such increases will be linked to the Retail Price Index (RPI excluding mortgage interest payments).

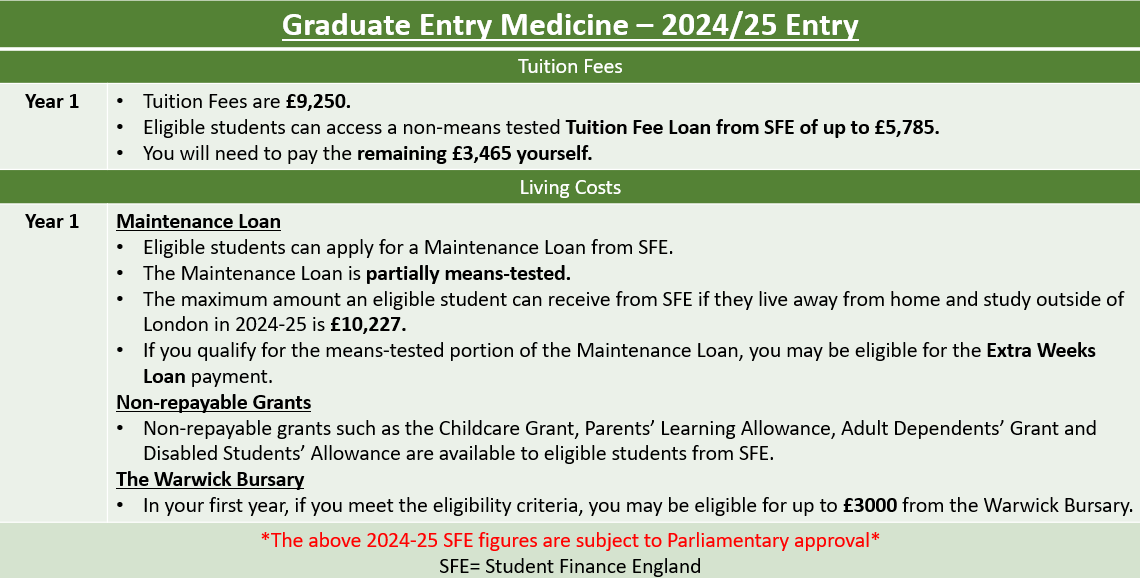

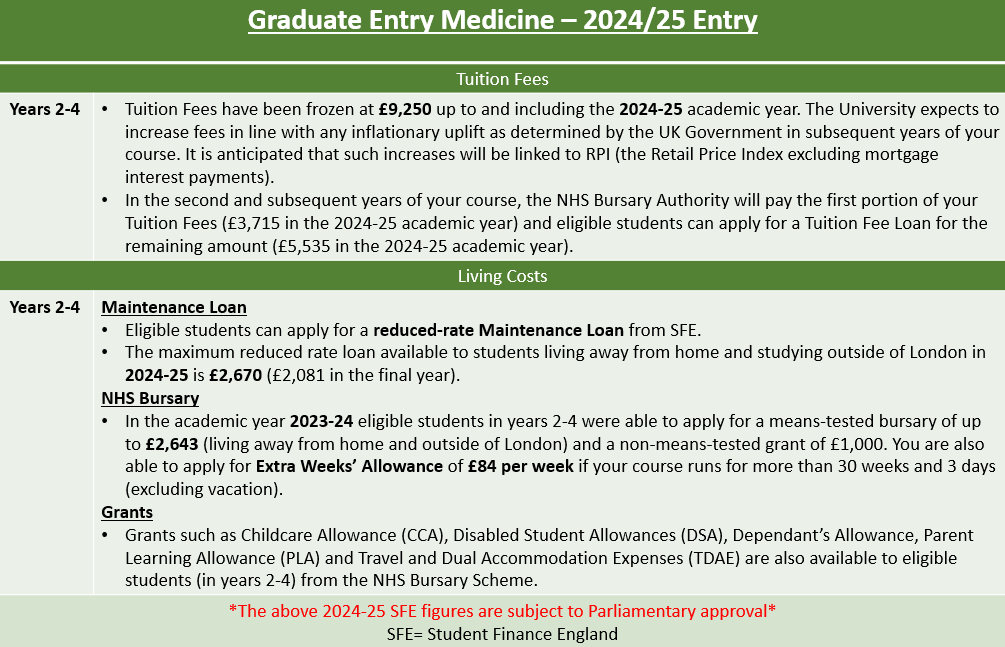

Financial support for graduate entry medical students varies depending on the year of study that they are in. The first table below demonstrates the tuition fees and financial support available to eligible students in their first year of this course in 2024-25. The second table demonstrates the tuition fees and financial support available to eligible students in years 2-4 in 2024-25.

- The NHS Bursary Authority has not yet released information regarding their financial support packages for students in 2024-25. Therefore below you will find figures from the 2023-24 academic year to give an idea of the level of financial support that may be available from them.

- For more information regarding the financial support offered by the NHS Bursary Authority in years 2-4 please see the following webpage, NHS Bursary Students. When the 2024-25 support package information is released, you should be able to find the figures in the previous link.

- The Warwick Bursary is only available to students in the first year of the graduate entry Medicine course. For more information, please see our Warwick Bursary- 2024 EntryLink opens in a new window webpage.

Paying Tuition Fees

In the first year of your course, you will need to self-fund a proportion of your tuition fees (£3,465 in 2024-25). For this self-funded proportion you need to pay, you can choose to either pay the entire amount at the start of the course, or in instalments according to the standard payment schedule:

- 50% due by the first day of Term 1

- 25% due by the first day of Term 2

- 25% due by the first day of Term 3

For further details, visit the University's Student Finance Team's Types of FeeLink opens in a new window and Making PaymentsLink opens in a new window web pages.

Eligible students can apply to Student Finance England for a Tuition Fee Loan for the remaining tuition fees (£5,785 in 2024-25). The proportion of fees due to be paid by Student Finance England for students who have successfully applied for a Tuition Fee Loan will be paid directly to the University without the student needing to arrange payment.

In the second and subsequent years of your course, the NHS will pay the first portion of your tuition fees (£3,715 in the 2024-25 academic year) and eligible students can apply for a Tuition Fee Loan for the remaining amount (£5,535 in the 2024-25 academic year). Students who successfully apply for a Tuition Fee Loan from Student Finance England and an NHS Bursary Tuition Fee contribution will have these paid directly to the University and will not need to arrange payments.

Maintenance Loan Entitlement

Eligible first-year students can apply to Student Finance England (SFE) for a partially means-tested Maintenance Loan to contribute towards their living and course costs.

For the 2024-25 academic year, household income will be taken from the 2022-23 tax year and will depend on the people you live with: your parent(s)/carer(s), your parent/carer and their partner or your partner.

- In certain circumstances your assessment might be based on your own income, for example, if you are aged over 25 at the start of your course.

- For more information on taxable income check out the GOV.UK webpage, Income Tax: Introduction.

If there has been a drop in your household income of 15% or more since the previous tax year, you should notify Student Finance England once you have applied for a maintenance loan, as you may be entitled to an increased entitlement. For more information see the following webpage, Support your Child or Partner's Student Finance Application - If your income has gone down.

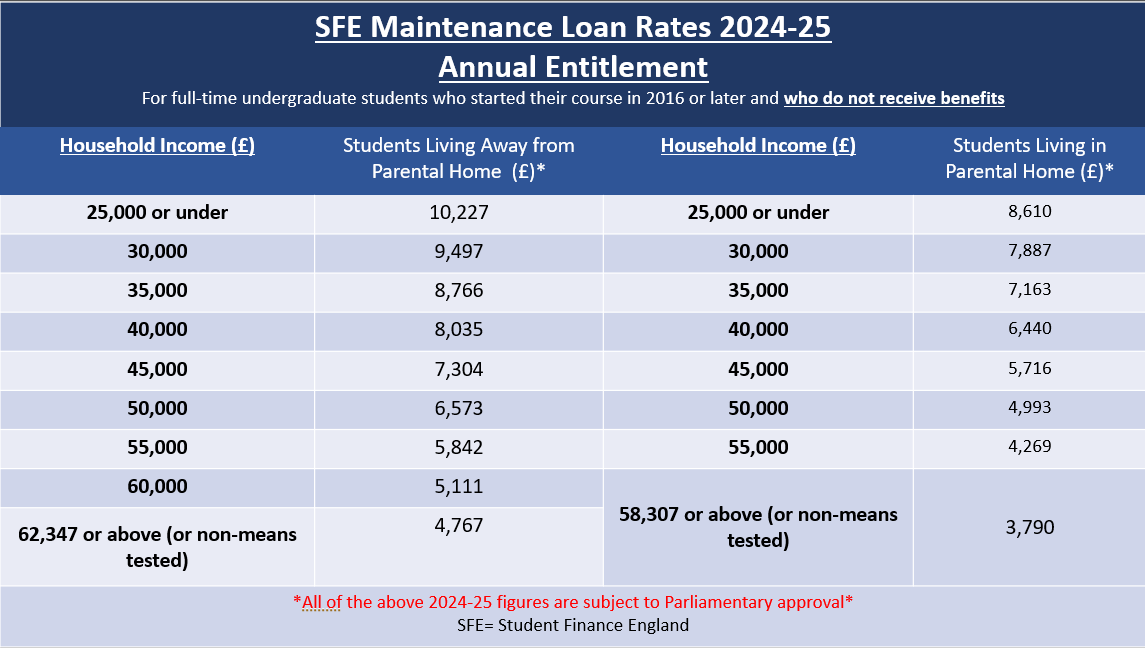

The below table demonstrates the maintenance loan rates for the 2024-25 academic year based on household income. Please note, the 2024-25 figures are subject to Parliamentary approval. These figures apply to students who are aged under 60 on the first day of their course and who do not qualify for government benefits. If you will be aged 60 or over at the start of your course or if you qualify for government benefits, please see our Students Eligible for Benefits or Aged 60 or OverLink opens in a new window page for the relevant figures applicable to you.

- The table below demonstrates the annual Maintenance Loan entitlement. The annual entitlement of Maintenance Loan is paid directly to students in equal termly instalments.

Please note, in years 2-4 students cannot apply for a means-tested maintenance loan. Instead, eligible students can apply for a reduced-rate maintenance loan which is non-means tested.

You will note that the table states "For full-time undergraduate students..." this is because, for the graduate entry Medicine course at Warwick, medical students are assessed in the same manner as undergraduate students.

Applying to Student Finance England (SFE) for the Tuition Fee, Maintenance Loans and Non-repayable Grants

Eligibility for the Tuition Fee and/or Maintenance Loan will depend on certain criteria, such as your nationality and residency status. You can view the full criteria at Student Finance for Undergraduates - Eligibility (for the graduate entry Medicine course at Warwick, medical students are assessed in the same manner as undergraduate students).

- If you are unsure whether you qualify for these student loans, you can Contact Student Finance EnglandLink opens in a new windowLink opens in a new window directly to clarify.

Applications for the Tuition Fee Loan and Maintenance Loan are made online, see the Student Finance England - How to ApplyLink opens in a new window webpage for more information. Aplications usually open in early March and there is a deadline of the end of May. You should apply as soon as the service opens to make sure that your funding is in place for the start of your course. The application takes about 30-45 minutes and you apply for both the Tuition Fee and Maintenance Loan in one application.

- You will need to apply for each year that you require a Tuition Fee Loan and/ or a Maintenance Loan.

The Non-repayable Dependants Grants available to eligible medical students from Student Finance England in their first year of study are:

- Childcare Grant (CCG)

- Parents' Learning Allowance (PLA)

- Adult Dependants' Grant (ADG)

- You can apply for these in the same application form as your Tuition Fee and Maintenance Loan. For more information on any of the above three grants, please see our Dependants' Grants Link opens in a new windowwebpage.

If you have a disability, long-term health condition, mental health condition or specific learning difficulty there is additional non-repayable support available from SFE known as Disabled Students' Allowance (DSA):

- DSA is intended to help with any disability-related costs you might have.

- You apply for DSA in the same application as your Tuition Fee and Maintenance Loan.

- Any support you receive will be based on your individual needs and not your household income.

- Make sure you apply early for DSA as applications can take up to 14 weeks as you will need to undertake a Study Needs Assessment.

- For more information on the support provided, the evidence required and how to apply check out SFE's Disabled Students' AllowanceLink opens in a new windowLink opens in a new window webpage and/or the University's Disability Team's Applying for DSALink opens in a new windowLink opens in a new window webpage. Within the University's Disability webpage, you will also find a DSA Eligibility CheckerLink opens in a new windowLink opens in a new window tool which you can use to see whether you may be eligible for DSA.

Repaying the Tuition Fee and Maintenance Loans

Students starting in the 2024-25 academic year who take out undergraduate student loans (which includes graduate entry medics at Warwick) will be on the Plan 5 Student Loan (see Student Finance England - Repaying Your Student Loan - Which Repayment Plan You Are On).

Plan 5 Student Loans:

- Repayments will begin in April after you have completed or left your course.

- Repayments will start only when your income is over the threshold of £480 per week, £2,083 a month or £25,000 per year (before tax and other deductions). This is the threshold from August 1 2023.

- Student loan repayments will be taken even if you don't earn over £25,000 in a year but exceed the weekly or monthly threshold at any time (e.g., if you work overtime or get a bonus).

- You will repay 9p for every £1 you earn over the threshold.

- Repayments are deducted automatically through the tax system. If you are self-employed or working overseas when your repayments are due to start, you will need to arrange separate repayment arrangements with Student Finance England.

- If your income falls below the £25,000 threshold repayments will stop automatically and not re-start until you are earning over the threshold again. If you are self-employed or working overseas while making repayments and your income falls below £25,000, you will need to contact Student Finance England directly.

- There are no early repayment penalties and you can choose to make voluntary repayments to your loan at any time.

- Any outstanding loan (including interest) is written off after 40 years or if you become permanently unfit for work or die.

- Interest is applied to your loan at the point the first payment is made to you and is linked to the Retail Prices Index (RPI).

As a postgraduate student looking to study graduate entry medicine, your previous undergraduate loan would be on a different student loan plan (see Student Finance England - Repaying Your Student Loan - Which Repayment Plan You Are OnLink opens in a new window) and hence your repayments may be different to the above.

- Your repayment threshold will be the lowest out of your undergraduate student loan plans.

- The repayment of your undergraduate funding would still only be in one payment and you will still only pay 9p for every £1 earnt over your threshold.

- If you have a postgraduate loan (i.e., Master's or Doctoral Loan) on top of a previous undergraduate loan, then you will repay 6p for every £1 earnt over £21,000 (or over £403 per week or £1,750, even if your annual income is not over £21,000) and then 9p for every £1 earnt over your undergraduate loan threshold on top.

- For more information, please see the webpage Student Finance England - Repaying Your Student Loan - How Much You RepayLink opens in a new window.

Applying to the NHS Bursary Scheme

You do not need to apply to the NHS Bursary Scheme until term two of your first year (for second-year funding). For more information about the NHS Bursary Scheme eligibility, please see the NHS Bursary webpage for the most up-to-date information. Here you will also find information regarding their further funding:

- Childcare Allowance (CCA)

- Parent Learning Allowance (PLA)

- Dependant's Allowance

- Disabled Student Allowances (DSA)

- Travel and Dual Accommodation Expenses (TDAE)

- NHS Bursary Hardship Grant

Maintenance Loan/NHS Bursary and UK Government Means-tested Benefits

Please note, if you receive a Maintenance Loan or an NHS Bursary, this may have an impact on any means-tested UK Government benefits that you are entitled to. Examples of these include (list not exhaustive):

- Income Support

- Income-based Job Seekers’ Allowance

- Income-related Employment and Support Allowance

- Housing Benefit

- Council Tax Reduction

- Working Tax Credit

- Pension Credit

- Universal Credit

You are advised to contact your local Citizens Advice Centre for more information:

Managing, Making and Saving Money

If you want to learn more about managing, making, and saving money, check out our Money Matters sub-section.

Further to this, Warwick Medical School have also created a dedicated Financial Advice and SupportLink opens in a new window webpage for Medical Students which includes information about additional funding opportunities.