Departmental news

Warwick Economics alumnus listed in Forbes 30 under 30 for Europe 2025

We are delighted that Josef Chen, a former student of the Department of Economics has been listed in the 10th edition of Forbes Europe 30 under 30 List for 2025. The list, published by Forbes annually, recognises exceptional achievements of 30 individuals under 30 years old, in 19 different categories.

Josef, who graduated with a BSc Economics, Politics and International Studies in 2023, has been listed in the Manufacturing & Industry category alongside his business partners, Piers Millar and Ivan Tregear, for creating Kaikaku, a robotics and AI startup that raised $4 million to scale the next generation of restaurants where repetitive tasks are automated so that humans can focus on the hospitality part.

The Forbes profile gives praise to Josef and his co-founders of Kaikaku for pioneering food-safe 3D-printed plastic components and manufacturing all of their hardware and software in-house at a central London lab behind its robotics-powered restaurant.

We asked Josef to tell us more about his career to date and his innovative business venture and here is what he said:

What was your career ambition after graduating from Warwick in July 2023?

"After graduating from Warwick, I was offered a place on the MSc programme at Imperial College London. But by then, I had already experienced investment banking, private equity, and venture capital through internships, and realised I wasn’t built to just analyse other people’s companies. I wanted to build, not watch. I felt a deep urgency to create something that could reshape the world. So, I decided to channel my creative energy into setting up Kaikaku rather than doing the MSc course.

In under a year, we launched the UK’s first robotics-powered restaurant with a fully operational site in London, open to the public, where our engineers work behind a one-way mirror. We call this our “living laboratory” because it allows us to iterate daily and gather feedback from paying customers in real time. That speed and obsessive execution earned me a spot on Forbes 30 Under 30, but the real credit goes to the entire team for their tenacity and true grit.

What is Kaikaku?

"Kaikaku is building the next generation operation system for restaurant chains, powered by robotics and AI but defined by customer experience. Our mission is to create the best restaurant experiences by building the world’s most vertically integrated restaurant hardware, software and AI.

Our first product is Fusion, a robot that can assemble more than 360 customised bowls per hour on autopilot, increasing throughput compared to a traditional operation by more than 300%. The goal isn’t to remove humans, but to automate repetitive processes so they can spend all their time delivering unique hospitality to our customers.

How did you come up with this idea?

"My parents opened a Chinese restaurant in a small Austrian town after immigrating from China. Growing up in that household meant 14-hour shifts stacking used dishes and translating stacks of German documents into Chinese starting when I was just 6 years old. That kind of trauma stays with you. Especially a hatred towards your parents for making you work while all your friends are spending their childhoods playing video games.

So, as a teenager, I swore I would never follow my parents and set foot in the restaurant industry again. But then, my mom said something that turned all my hatred into a lifelong challenge: “Making you work in the restaurant was the only time me and your dad as restaurant owners got to spend time with you.” Few weeks later, Kaikaku was born.

What does ‘Kaikaku’ mean?

“Kaikaku” means radical change in Japanese. While most of the food industry embraces Kaizen, the philosophy of continuous, incremental improvement popularised by Toyota, we take a different path. We’re fundamentally rethinking the entire system.

What’s your key business goal and how are you going about it?

"I want to be synonymous with restaurants just like Bernard Arnault is synonymous with luxury goods. While still very early, we’ve already proven our ability as an extremely lean but top-tier team, to consistently ship technology 10 times faster and cheaper than most of our competitors. We are excited to announce a string of significant partnerships very soon!

What’s your vision for the restaurant of the future?

"I imagine it to be an extremely personal and human experience with technology handling everything that’s transactional. By removing the repetitive grind, our team can focus on what truly matters: the customer. Robotics doesn’t replace the human touch but enables it.

What Warwick skills and experiences shaped you?

"For me it’s time management. Warwick’s community gave me the motivation and energy to achieve more. For example, during COVID, I launched a nonprofit alongside 15 other Warwick students where we digitised 250+ restaurant menus across the Midlands to allow for digital ordering.

What was the most valuable part of your BSc in Economics, Politics & International Studies?

"The most important aspect of my degree was learning to think in an interdisciplinary way. Economics and Politics may seem like separate fields, but in the real world, they’re deeply interconnected. For example, economics taught me how to dissect market behaviours and incentives, while politics helped me understand the power structures and institutions that influence those behaviours.

This combination has been key in shaping how I approach real-world challenges like incentive structures behind restaurant operations and how technology can reshape that. It’s helped me design solutions that are not just innovative, but practical, by considering the entire ecosystem, from people to processes to technology."

We thank Josef for this interview and congratulate him on his success.

From Management Consultant to Executive and Life Coach: meet our alumnus Simon Huss

We caught up with Simon Huss, a former student of the Department of Economics, who tells us about how his career path has developed and evolved since graduating with a MSc in Economics in 2011.

What career path did you decide on when you completed your Master's in Economics at Warwick?

I graduated with a Master’s in Economics from Warwick in 2011 and my career has taken a few turns, each one bringing me closer to a life that feels more aligned. From management consulting to a tech start-up, I have now found my home in Executive and Life Coaching.

After university I found a natural fit in management consulting, where I could explore different industries and solve diverse problems. I joined the strategy consulting firm L.E.K. Consulting and thrived in the fast-paced, demanding environment surrounded by brilliant people. But after two years, the lack of work-life balance took its toll, and I knew it was time for a change.

Did you manage to achieve a better work-life balance in your next career move?

I moved into independent consulting, which gave me the freedom to choose my projects and work directly with leadership teams. This included work on global strategy and transformation projects with John Lewis, BT, and Coca-Cola. It was intellectually stimulating, financially rewarding, and I had my evenings back. But after a few years, I began to long for something more meaningful.

This led me to a rapidly growing tech start-up, where my work had a direct and immediate impact. In the intensity of the start-up environment I found myself informally coaching other senior executives, helping them to grow as leaders. When I was tasked with building a coaching team to support the company’s growth, I discovered an approach that made personal development both accessible and transformative. Something clicked.

This wasn’t just a solution for the business. It connected to something much deeper in me.

What did you do next to align your personal and professional goals?

For almost two decades I’d been on a personal development journey, exploring meditation, embodiment, spirituality, and building community around these practices. These experiences have enriched every area of my life. Over time, I led workshops and retreats to share this with others, simply because I loved the work. And now I saw a path to turn my passion into a profession.

"Either you take the lead in shaping your life, or someone else’s expectations will do it for you."

What kind of training did you have to undertake to become a life coach?

I trained extensively with leading coaching schools, deepening my expertise and refining my approach. Now, I work with founders, directors, and high-performing professionals who are looking for more, not just success, but fulfilment. I help them to get clear on the life they long for, even the one they may not yet feel they deserve, and I support them to make it real.

After years of following a path, there comes a moment to ask if it’s still yours. Then, taking the lead in shaping your life becomes not just important, but essential.

How can the Warwick Economics alumni community reach you?

I'd love to hear from you if anything in my story resonated. You can reach me at Explore@SimonHuss.com or at https://www.linkedin.com/in/simonhuss/. I’m always happy to connect with fellow Warwick alumni.

We thank you, Simon, for getting in touch with us, and wish you the best for the future.

Warwick Economics alumna listed in Forbes India 30 under 30 for 2025

We are delighted that Soumya Dabriwal, a former student of the Department of Economics has been selected for the Forbes India Directory 30 Under 30. The list, published by Forbes annually, recognises exceptional achievements of 30 individuals under 30 years old, in 19 different categories.

Soumya, who graduated with a BSc Economics degree in 2016, has been listed in the NGO & Social Entrepreneurship category alongside her enterprise partner Aradhana Rai Gupta, for creating Project Baala, working to provide quality, low-cost menstrual products, and creating awareness about menstrual hygiene and health.

Soumya and Aradhana’s Forbes’ profile states that since 2017 their enterprise has reached a million beneficiaries across 28 states in India, apart from Ghana, Nepal, and Tanzania.

In a news article on the Warwick Alumni webpage Project Baala: Breaking the cycle of taboo, published two years ago, Soumya said that it was her visit to Ghana as part of the Warwick in Africa scheme and later her volunteering for Warwick in India programme during her BSc Economics studies, inspired her to set up Project Baala.

Soumya commented on her success:

“Being recognised by Forbes 30 Under 30 is an incredible milestone for both Baala and myself. This recognition is not just about me, it’s about the incredible people, stories, and resilience that have shaped Baala. We’re just getting started.”

We congratulate Soumya on this fantastic success and wish her and Project Baala further successes in the future.

Related articles

Forbes India 30 Under 30 2025: Meet our young groundbreakers and trendsetters

Warwick Economics represented on new Commission of Experts tackling debt in the global South

Emeritus Professor Marcus Miller and Economics Alumnus and Honorary Warwick Graduate Dr Mahmoud Mohieldin have been invited to join a prestigious commission that will address the sovereign debt and development crises affecting countries across the Southern Hemisphere.

The Commission of Experts is an initiative of the Pontifical Academy of Social Sciences (PASS) and Columbia University’s Initiative for Policy Dialogue (IPD). It is inspired by the Roman Catholic tradition of the Jubilee, an annual event once every 25 years, which can include calls for social and financial justice.

The Commission’s members are tasked with developing reforms to the international financial architecture that would enable countries across the Southern Hemisphere to achieve sustainable debt levels; allowing them to increase investment in healthcare, education, clean energy, and climate adaptation.

Professor Miller said:

“Joseph Stiglitz is, I guess, the prime mover behind the idea of producing a Jubilee Report on the Debt and Development Crises in Countries from the South, ably supported by Martin Guzman and Sr. Helen Alford.

“Inspired by the impact that previous pressure in the year 2000 had in promoting the HIPIC program for reducing the debt of many Heavily Indebted Poor Income Countries, they’ve contacted academics and practitioners in the fields of development and debt with the goal of generating an agenda of positive steps 25 years later.

“Having written on debt restructuring with Joe Stiglitz, I was invited to join the panel, which started with a nuts-and-bolts workshop last week.

“As well as debt write-downs and interest relief for the poorest countries, matched by commitments for promoting health and education and tackling the issue of over-borrowing, options for improving debt contracts and for IMF reserve allocations to assist with liquidity and rollovers were outlined.

“These and other proposals are to be embodied in a Report which - with the moral support of the Catholic church - is to be presented to the Finance for Development Conference in Seville in June.”

UN envoy Mahmoud Mohieldin, PhD and recent Honorary Graduate from Warwick, is also a key member of the Commission, advocating a greater role for Multilateral Development Banks and a comprehensive revision of IMF quotas.

Dr. Mohieldin said:

“I am honoured to join the Jubilee Commission among distinguished scholars and experts. Our task to suggest reforms to address the sovereign debt and development crises affecting developing countries is indeed challenging but very pertinent.

“Public debt in developing countries has surged at twice the rate since 2010, with median external public debt service rising from 5% of government revenues in 2010 to 8.8% in 2022. The creditor landscape has shifted significantly, with over 60% of lenders now being private, making debt more expensive and restructuring more complex. Concurrently, debtor countries now face a growing challenge of balancing essential public spending with debt service obligations. Given their costly debt service bills, many developing countries are forced to de-prioritize spending on basic social services, such as health and education, as well as essential investment in long-term infrastructure, ending up with limited capacity to achieve SDGs, the most important of which is combating extreme poverty. The problem today is not just countries defaulting on commercial debt but rather defaulting on development.

“As the United Nations Special Envoy on Financing the 2030 Sustainable Development Agenda, and also mandated by the UN Secretary General to lead a group of prominent experts to promote solutions for resolving the debt crisis, it is my conviction that the debt crisis of developing countries must be treated through a development-oriented approach that aligns suggested solutions with the SDGs. I am looking forward to continuing working with my fellow commissioner to present concrete, fair, inclusive, actionable and durable recommendations that inform the Fourth International Conference on Financing for Development (FfD4), which will take place from 30 June to 3 July 2025, in Sevilla, Spain.”

- Read more on the PASS website: Press Release Jubilee Commission

Meet alumnus and Paris Paralympics Medallist - Dani Caverzaschi

This summer’s Paralympic Games saw a triumphant return to form for Warwick Economics graduate and professional wheelchair tennis player Daniel Caverzaschi after almost two years off the court owing to injury and surgery.

With his doubles partner Martín de la Puente, Daniel won Spain's ever first medal in wheelchair tennis - a bronze – in a dramatic match on the famous Roland Garros courts.

Daniel’s Paralympian journey began during his first year at Warwick, when he qualified for the London 2012 Games.

He shares with us some reflections on his summer of sport, memories of his time at Warwick and his busy life away from the courts:

Tell us about your experience of taking part in the Paralympic Games in Paris. What was the atmosphere like?

The atmosphere in Paris was something truly special. Winning the bronze medal against the French pair on the courts of Roland Garros, stadium absolutely packed, was a moment that dreams are made of. Seeing a full stadium for wheelchair tennis was an absolute highlight for me. And confronting a full stadium of French cheering like crazy for my opponents (and sometimes even booing us), may sound funny, but actually represents the integration I want: where people don’t see the disability in us, but just the fierce competitors who, in this case, they want to beat! This is the perfect representation of disability normalisation, isn’t it?

It’s hard to say if these were my favourite Games, but I will certainly never forget them. Just being there was already a personal victory, and winning Spain’s first-ever wheelchair tennis medal made it even more unforgettable.

One clear takeaway from Paris is that interest in adapted sports is growing significantly.

What were your expectations going into the Games – in singles and in doubles?

At the start of the year, my main goal was simply to qualify. After the injuries and surgeries, I wasn’t sure how far I could go. In singles, I wanted to build on my past performances, but the Games felt too soon after my injury. However, all my singles matches had a lot of drama, and when I put everything into perspective, I’m satisfied with my performance.

In doubles, Martín and I knew we had a chance, but we had to beat one of the favourite pairs, the Dutch. Once we did, we knew we could make history. The semifinals are still hard to think about—we lost against the world number 2 pair in a super tie-break by just two points. That’s elite sports for you! We had a strong chance going into the bronze match, but playing against the hosts is always complicated. Perhaps it was meant to be that we had to lose the semifinals to win the bronze against the French. After all, they say the Spanish love playing at Roland Garros!

What do you think of as your most satisfying career achievements?

Winning the bronze medal in Paris is definitely one of my career highlights. It wasn’t just about the medal but about the long road it took to get there. My Paralympic diplomas in Rio and Tokyo were also important milestones. These moments are special because they show my consistent effort over the years and the progress we’ve made in wheelchair tennis as a sport. Of course, the Paralympic Games are extra special, but we also compete in the four Grand Slams—playing at Wimbledon, the US Open, Roland Garros, and the Australian Open is an experience like no other. I can’t wait for the Grand Slam season to kick off in Australia in 2025; I feel more ready than ever. The best is yet to come, my friends!

How have you managed to stay so competitive at the elite level for so long in a sport in which the competition keeps getting tougher?

It comes down to discipline, both physically and mentally. The level of competition keeps increasing, which pushes me to work even harder. I focus a lot on physical training, but mental conditioning is just as important. Surrounding myself with the right people has also been crucial. I’ve always had a great team behind me, and their support has helped me maintain my competitive edge. I also have very clear goals, which keeps my hunger for success alive.

Another key factor, and something which I think is important for sports but for life in general, is keeping a resilience mindset and seeing all the barriers that come to you as opportunities to grow and to come back stronger. I’m very proud of how I’ve managed the setbacks in my career and in life. This has led me to come back so fast to the Top10 after a serious injury and surprise everyone - even myself - this past year.

Where did your initial interest in tennis start? And who has been most instrumental throughout your career?

I’ve loved tennis for as long as I can remember. As a kid, my parents encouraged me to play many sports, regardless of my disability. I really enjoyed skiing, but it’s probably best I swapped the skis for the racket because I’m known to be a bit too daring! Once I started playing wheelchair tennis, I knew it was the sport for me. It's also one of the most professionalized adapted sports out there, with a strong competitive yearly calendar. My family has always supported me, and I’ve had amazing coaches who have guided me throughout my career. There have been many people along the way—mentors, teammates, and even competitors—who have inspired me to keep improving. A big shoutout as well to my sponsors, some of which have been supporting me for the past decade, for believing in me throughout all these years.

How did you manage to combine intensive training - and qualification for London 2012! - with studying for your (first-class) degree at Warwick?

Ufff, that was a tough one. I can remember the exact moments as if it were yesterday… I remember my conversation with Robin Naylor where I had to make a decision in February whether I should take a gap year in order to focus on traveling the world and qualify for London 2012, or attempt both things at the same time, risk failing one of the exams and not being able to take the resits because it coincided with the Games. It wasn’t an easy decision. Robin was incredibly supportive and gave me the confidence I needed. I obviously chose the risky decision… And it was all about time management and a lot of discipline. Balancing my degree with training for the London 2012 Paralympics and traveling 9 weeks in 3 months all around the world from February to May, just before the end of year exams, was extremely challenging and stressful, but as I said I’m someone who enjoys a good challenge. I had to make sacrifices, but ultimately, my passion for both tennis and my studies kept me motivated. And the confidence that my parents and Robin gave me in giving it my best. Late nights, early mornings, and discovering the role of coffee in those moments were part of the routine, but it was worth it in the end. The grind it took to accomplish those goals led me to one of my most happy memories. That’s when I realized that giving it all, regardless of the outcome (in this case it was positive but in other cases it wasn’t), brings happiness.

What are your strongest memories of studying Economics at Warwick?

Warwick was an amazing place to study. I have great memories and made many friendships that last to this day. Aside from the social element, graduating with a first-class degree in Economics was a huge sense of accomplishment. The university was a community that supported and encouraged me, both academically and athletically, while the discipline I learned during my time at Warwick has carried over into my tennis career.

Please bring us up to date with what you’ve been doing professionally away from the tennis court since you graduated.

Since graduating, I’ve focused a lot on using my platform to promote and normalize disability through sport. In 2023, I co-founded VLP Sports, which works with brands to raise awareness about athletes with disabilities and create impactful campaigns. I’ve always wanted to be an entrepreneur, and it made sense to combine my passion for sports with disability normalization and apply some of the elements I learned with my economics degree as well!

How do you combine elite tennis with your other roles and ambitions?

It’s definitely a balancing act. Tennis is my main focus, but my work with VLP Sports is also a big part of my life. I’ve learned to manage my time effectively and have built a great team to support me in both areas. It’s not always easy and requires making sacrifices, but I’m passionate about both and have found a way to make it work. My team helps keep everything on track, allowing me to continue competing while also pursuing my other professional goals.

You have written that one of your passions is to motivate people to see problems as opportunities for growth and differences as advantages. Could you tell us more about this as an approach to life?

I believe that we all face challenges, but it’s how we respond to those challenges that defines us. I was born with my disability, but I didn’t let that stop me from pursuing my dreams. Instead, I’ve used it as a source of strength. I want to show people that differences are not limitations—they are opportunities to grow and excel. My goal is to create a world where social barriers don’t exist, and where everyone is judged on their abilities, not their disabilities. This is my mission, and it’s also the mission of my company, VLP Sports.

We wish Daniel every success in his 2025 matches!

Photo (published with permission of Dani Caverzaschi): Dani Caverzaschi (left) with Martín de la Puente (right) at the Paris Paralympics Games 2024.

Warwick Economics alumna on a mission to close the gender wealth gap

We have caught up with Lis Prager, Warwick Economics alumna and Fintech entrepreneur to get an update on how her mission to close the gender wealth gap was progressing. Back in 2023 we found out from Elisabeth how and why she and her business partner and friend Nitika (also Warwick alumna) were trying to set up a personal finance solution combining education, guidance and access to advice.

Back in June 2023 you told us that the gender investment gap was huge, with high-earning women losing out on almost £800K over their career by not investing (Ellevest 2018). How are you trying to solve this problem?

"You’re right – the investment gap is big, and the gender wealth gap is even bigger! Women, despite having ever-more money and assets, face a variety of challenges when it comes to building wealth. What is building wealth? Simply said, it’s growing your money to achieve the life you dream of. What does that take – it takes knowing what you want to achieve, having a plan to achieve it and then getting the education, guidance and accountability to make it happen.

Women specifically lack access to relevant financial plans, solid and accessible education and relatable and timely guidance. We’re time poor, don’t have sufficient financial education and don’t see ourselves in the advisors who say they’ll manage our money. Consequently, we feel disempowered when it comes to our money and don’t do anything… Aila is addressing this by putting a digital personal trainer for your finances in every woman’s pocket, so she can invest, save and budget to achieve the life she dreams of."

"Like a sports personal trainer, who helps you understand your current level of fitness and then crafts a personalised plan, educates you and holds you to account to help you achieve your fitness goal, Aila does the same with money."

According to Nordic Fintech Magazine Aila Money is listed as one of the fintech company to watch! Described as one of those companies that push boundaries, transform industries, and shaking up the status quo with their creative energy.

As a co-founder of Aila Money what boundaries are you pushing and what are you trying to transform?

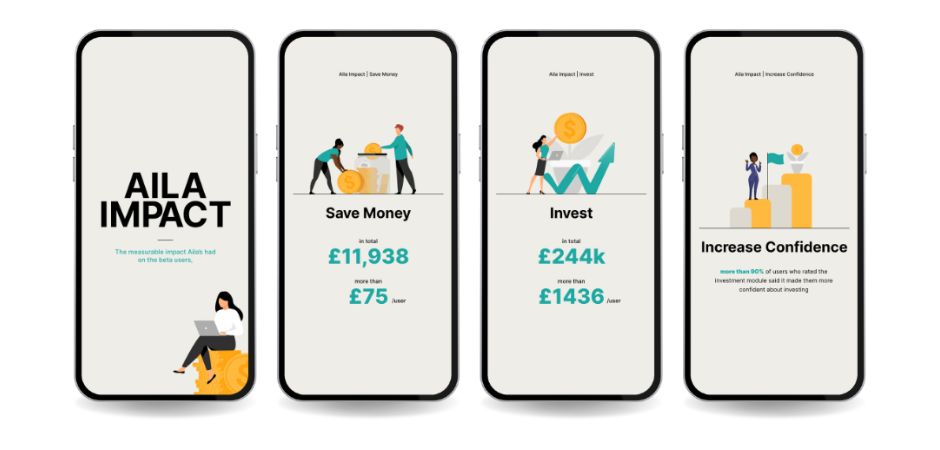

"We are really trying to push the boundaries on how to empower women to build their wealth. We’re democratising financial planning and guidance for women. As mentioned, we anchor all the plans, education and guidance in the users’ life goals and their data. This personalisation of education and guidance makes finance relevant to women and helps them change their money behaviours in a sustained way. This was demonstrated by users on our no-code beta version saving on average hundreds of pounds, 90% feeling more confident about their money and, the average user starting to invest over £1500 per year."

What have you been focusing on in the last 18 months?

"As a founder you wear all hats – from strategic, to operational – from thinking through business models, to crafting the financial models, to crafting brand and marketing plans, to executing the post or editing the video, to creating the product prototype, to hiring the team and managing the team that will build it. That being said, two focal areas emerge:

- Creating a truly user-centric product – we built and tested a no-code version of Aila and grew the number of users to over 200. This gave us great insights and a good understanding of our engaged user, to allow us to build the Aila app.

- Building a community – we’ve been trying and testing different messages, tools and formats to understand and build a community around Aila. This has given us a great insight again into who we serve and what their thoughts and challenges are when it comes to growing their wealth."

Tell us about Aila Money App. What does it do and why should it appeal to women in particular?

"Aila helps you calculate the cost of your life goals, then – based on where you are today – helps you plan how to achieve them, sets and tracks actions so you complete them. Aila also educates you based on your goals and data and embeds behavioural science to make sure you stay motivated along the way. And yes, we also recognise that sometimes a digital solution isn’t enough, so Aila has a marketplace of human experts (coaches and advisors) to help.

If that sounds abstract, take a moment to think of the life you want to lead – you might want to buy a house, get married, start a family and maybe one day start a business or go on a travel break. Each of these things will cost you something, but rarely does someone calculate that total (and often scary) number of your dreams. If you don’t know what you’re aiming for, it’s hard to put in place a plan and even harder to achieve it."

Does Aila utilise anything you learned at Warwick?

"Aila does embed things I learned at Warwick; ranging from topics like inflation, compounding and interest rates which were covered in stats, to more intangible ones like helping people understand their beliefs around money (which we I remember covering in part of the history of economics)."

Have you fully embraced AI solutions within the App?

"We’ve begun embedding aspects of AI into Aila. We have ambitious plans and are already working with some researchers to understand how people want their financial guidance and advice delivered by an AI. It’s super interesting – we’re learning things every day!"

What are your goals for 2025 and beyond?

"We launch the Aila app in January 2025 and are really focusing on traction and engagement – we want to create a product that not only solves the wealth gap but truly empowers women when it comes to their money. We’ll also be starting a pre-seed fundraise so we can continue to develop the product and start embedding the machine learning and AI that can personalise things even more!

Join our journey – download the Aila app today and follow us on socials to see what we’re up to!"

We wish Lis and her business partner Nitika lots of success with the Aila app launch.

Related content

- Aila App is available (for Apple and Androids) from Aila website.

- Previous article: From Warwick Economics graduate to FinTech entrepreneur: Interview with alumna Elisabeth Prager

Warwick Alumna Caroline Escott Leads the Way in Sustainable Finance

Over the past 25 years, sustainable finance has grown from a visionary concept discussed at UN climate conferences to a multi-billion dollar market. It’s an umbrella term used to refer to an investment approach that takes environmental, social and governance factors into account when deciding where to invest.

One of the biggest names in sustainable finance today is Warwick alumna Caroline Escott. Regularly cited in lists and surveys of the industry’s most influential figures, she’s taken a range of interesting and exciting roles since graduating in the class of 2006, and is now Senior Investment Manager for one of the UK's largest pension schemes, Railpen.

We caught up with Caroline to hear about her career choices, the skills she believes are essential to make a success in the financial markets, and why she believes sustainable investment is one of the most effective ways to achieve both good outcomes for pension savers and positive change in the world.

Caroline, you have been named as one of the Top 50 Most Influential in Sustainable Finance by FinancialNews - can you explain what sustainable finance is?

Sustainable investors are responsible for allocating capital to companies where they are either doing well on environmental, social and governance issues or where they can be influenced to do better. Sustainable finance can also help drive flows of capital to those companies and sectors that are most important for the ongoing sustainability and viability of the world around us, such as new carbon emission abatement technologies or low-carbon infrastructure projects. As investors, we can – and do – try to influence individual companies, but it can be especially powerful to help shape the regulatory environment that governs how these companies behave. This is particularly the case when it comes to big, system-wide issues like climate change, biodiversity or labour rights.

Over the last few years, you have come to specialise in sustainable finance, especially within the area of pension schemes. What has brought you to this focus? What impact would you like to have within this?

If you are interested in influence and effecting positive change, then you need to be at an organisation where the decisions which are made matter to people’s lives. Pension schemes are perfect for this in two main ways. Firstly, they have a privileged role as large capital allocators, sitting at the top of the investment chain. Secondly, people rely on their pension schemes for their retirement income. In the UK, there are huge numbers of people at risk of an inadequate income in retirement, making this one of the biggest challenges we face as a country – and a vital field to work in.

I hope that the contributions I make to this work – including setting up and leading large global initiatives like the Investor Coalition for Equal Votes (ICEV) and the Workforce Directors Coalition (WDC) – will help bring about much-needed change in the best interest of pension scheme members.

You have made a few different career changes, from Parliamentary political research to finance and investment, all within the general theme of public policy. What made you want to make these changes, and what gave you the confidence to do so?

Moving between different sectors has happened in large part because of my work to build industry networks. I enjoy meeting new people and learning new things. This has helped me build a high-quality and wide network of experts and I’ve been fortunate to have been recommended to interview for well over half of my roles by people who I’d worked with on projects in the past – even where I was, on paper, the ‘wildcard’ candidate. I’ve now moved sectors enough that I recognise for myself the huge importance of transferable skills and the right attitude in being able to adapt to, and then thrive in, a new role.

Public policy and advocacy have always been at least part of the roles I’ve taken up. While at Warwick, my studies quickly helped me understand the huge influence that flows of capital as well as the regulatory and policy framework can have on the world around us – and that the real potential for effecting change lies where these two intersect. Even now, heading up the investment stewardship programme at Railpen, I’m a keen advocate of investors learning about how to effect policy and regulatory change.

What skills did you learn during your degree at Warwick that you still use in your role at Railpen now?

Studying economics changed how I see the world and taught me to take time to consider and understand the assumptions underlying anything from a substantive piece of research to the way in which a question in a meeting has been structured. Being able to understand and then potentially question the assumptions used is fundamental to the critical thinking that has become even more important as I take on more senior and leadership positions in my career.

What is your best memory of the University of Warwick and the Department of Economics?

It’s hard to choose just one! When I think of Warwick, I think of all the times I spent sitting and chatting with my friends – or people watching, reading a book, or getting ready to go to Top Banana.

I also remember the keen thrill of anticipation at the sheer number of modules I could choose to take as part of my degree. I ended up plumping for Italian language and translation, and a few economic history modules during my time.

You were involved in a few different societies during your time at Warwick, including Latin and Ballroom Society, and Warwick Economics Society. How did your time with these societies impact you, and what skills did they develop?

First – and perhaps most importantly – I met great people, some of whom are still close friends today. However, I also found the leadership roles I took on in these societies vital to helping me get my first job without much ‘proper’ work experience. I had both learnt and was able to demonstrate an ability to think more strategically, to organise my time effectively and to motivate a diverse group of individuals to achieve a particular outcome.

Caroline Escott (BSc Economics, Politics and International Studies, 2006)

You can find Caroline's op-ed on sustainable finance in The Times here.

Graduate, Consultant, Chef and Co-Founder: an Interview with alumnus Alan Tang

67% of Warwick Economics graduates choose careers in finance, consulting, technology and government*. But a degree in economics opens the door to a wide variety of professions, both traditional and non-traditional. We caught up with alumnus Alan Tang to discuss his fascinating career changes, how his degree at Warwick equipped him with the confidence and skills to work in multiple fields, and his new role as Co-Founder of educational social impact business Collaboration Laboratory.

Alan Tang graduated from BSc Economics at Warwick in 2010, heading straight into a Senior Audit Associate role at Grant Thornton UK. After working for 6 years in corporate finance, Alan took a two-year sabbatical to train as a chef, working in some of the top restaurants in London.

Alan then went on to create his own consultancy company to develop new startups, taking the role of Director of Special Projects for different businesses such as Tailify and Eaten Alive. In July 2023, Alan set his sights on a new project, founding a social impact business to teach children key social and soft skills: Collaboration Laboratory (CoLab). We spoke to Alan about his fascinating career journey.

After graduating from Warwick, you began working in the corporate finance sector, following an internship with Grant Thornton. What made you want to enter this sector?

I chose to go into finance as it was a career that opened many doors. I remember being inspired by my Principles of Finance lecturer Peter Corvi. His lectures were always practical and fascinating and he played a big part in my decision to go into corporate finance.

After your time in finance, you then decided to take a sabbatical and train as a chef. This is a huge career change – what gave you the confidence to decide and initiate that change?

I had a good amount of savings built up, I had a strong enough CV to act as a backup plan and I had spent time doing my due diligence (working in restaurants part time, volunteering at food pop ups) to know what I was throwing myself into. I loved those 2 years as a chef and I don't regret it for a moment! This mindset shift of believing that I could change has helped me in so many parts of my life and I wholly recommend it to anyone.

You then decided to step into consultancy and set up your own business. After already experiencing two major industries, what made you want to try consulting?

I love the variety involved in consultancy. You're often presented with a problem that no-one else has solved and it's up to you to figure out and build what the MVP (minimum viable product) solution looks like! I recently had to help an employer brand agency build an employer brand sentiment tracker and did everything from finding vendors, analysing the data, building the dashboard and selling the service line!

How has your degree in Economics at Warwick equipped you for your professional life and the major career changes that you have made?

My economics degree gave me the qualitative and quantitative skills I've needed in each of my start-up and corporate roles and I'm thankful for that. The biggest value added, however, came from the curiosity that was instilled into me by my tutors and also the friendship groups that I made at Warwick. I'm still very close to my economics group and rely on them frequently when I have challenging situations to deal with.

The biggest takeaway from my economics degree has been an ability to articulate fairly complex ideas and frameworks in an easy to understand manner. I often have to explain quite complex ideas to a range of audiences and the ability to do this with a sprinkling of storytelling makes life much, much easier as a consultant.

Alan’s latest venture is CoLab. Co-founded in July 2023, this project aims to teach school children different social and soft skills needed in the modern workplace, through a variety of online games, discussions and escape rooms. CoLab currently reaches 11 countries, and encourages its 170 students to work across their various language barriers and cultural differences to problem-solve. The business also works to reduce educational gaps and has given over $10,000 of scholarships to children from less privileged backgrounds.

Alan, when did you become interested in social impact work and the focus on children’s education?

My family have a history of supporting schools in rural China but it wasn't until I started working at Synthesis that I realised the true impact education could have on the world. After working 10+ years in for-profit organisations I wanted to put my time and effort towards a project that made a difference.

In my experience, soft skills (especially emotional intelligence and communication) are crucial to succeeding at work and in your personal life and they're skills that become increasingly difficult to learn as you grow older. When I interview graduates who are looking to join the start-ups I advise, many of them sadly struggle to break down a problem if it's slightly outside of their comfort zone. I don't doubt that they have the ability to solve the problem but I think that many graduates are so focussed on learning exam technique to pass exams that they've forgotten the real purpose of learning. I suspect a fear of failure also plays a part in this. We started CoLab to help kids develop a toolbox of skills that they can apply across a variety of situations and scenarios - all via experience-based learning.

CoLab is an incredibly diverse project and allows its pupils to learn about and share cultures. What impact does diversity have on a child’s development?

CoLab is intentionally global because we want kids from around the world to meet. The idea is that this will lead to diversity of thought, sharing of cultures and will also help to remove any unconscious biases that they may have previously had. We recently had a student share about Diwali and how it's celebrated in India and that was a really lovely moment to witness. Many parents have also said that they want their child to develop their confidence in the English language and CoLab provides this opportunity in a fun, low pressure environment.

CoLab also aims to make education and development more accessible for children, and will have made a huge impact to children’s lives through the scholarships that you have offered. What is the value of accessibility for education?

Having seen how hard my parents had to work to support me through university, I strongly believe that wealth shouldn't be a barrier to good education. I think that there's enough literature out there to show that education is core to escaping the poverty cycle and I hope the work we're doing at CoLab can help towards this.

Corporate finance, cheffing, consulting and social impact – what’s next?

I'm focussing on growing CoLab and also supporting other social impact/food businesses that interest me. I want to help CoLab become a sustainable business that does even more good. Ideally we get to 250 students and then have an internal reset to think about how we could make CoLab even better.

Right now, I'm fundraising for a kimchi manufacturer, coaching the founder of an ethical debt collection business and investing in a variety of environmental startups. I want to do my bit to help the world and hopefully inspire others to do the same.

Alan Tang, BSc Economics 2010

*based off the Economics Undergraduate Destinations Report 2022.

Warwick Economics alumna on a mission to share her knowledge

Class of 2016 MSc Economics alumna Ankita Pathak got in touch with the exciting news that her book on Macroeconomics is a best-seller in India.

Since graduating, Ankita has been working as an economist in the Indian capital markets. The questions she encountered every day from clients, colleagues and managers inspired her to write The Macro Faire, which introduces macroeconomics in simple language with a specific focus on the Indian economy.

Ankita says:

“While textbooks are great, they never offer a practical perspective. Additionally, very few books cover the Indian economy in particular. I felt the urge to write what I know as an answer to those questions. It also turned out to be a great learning exercise for me.”

After 7 years in the capital markets Ankita has returned to study and has been accepted onto the MBA programme at INSEAD.

We asked Ankita to tell us more about her publishing success, her reflections on being a Commonwealth Scholar at Warwick, and her plans for the future.

What were your first career steps after graduating?

I was a Commonwealth Scholar at the University of Warwick. Staying true to this mission, I chose to contribute to India and its economy. I came back right after graduation and started working as Senior Economist at an institutional equity broking firm. I also worked very closely with organizations that contributed towards the education of teenage girls.

Can you tell us more about what being a Commonwealth Scholar meant for you?

The scholarship was an instrumental step in me finding the resources to study in the UK. I felt its mission, imbibed it and - to my best abilities - delivered it.

Warwick has insightful modules in Public Policy and Development Economics. Taking them as my electives made me realize the importance of the mission of the Commonwealth Commission even further, and I was further inspired by the opportunity to interact with Mark Carney, then Governor of the Bank of England, on our farewell dinner.

Being a commonwealth scholar at Warwick was something which changed the course of my life - it accelerated it in the right direction.

What’s the focus of your book?

The focus of my book is macroeconomics and very specifically, the many indicators in the subject such as growth, inflation, trade, balance of payments and many more. The book effectively simplifies these complex topics and tailors their understanding for investing in asset classes- equity, debt, commodity and currency. While the examples are from an Indian context the theory is pretty universal. Also, the book is a toolkit and application of the concepts can still be very individualistic.

How long did it take to write it?

I think it’s fair to say that it took two years of planning and 6 months of actual sitting down to write regime for me to make sure the book sees the light of day.

How did you keep yourself motivated to finish it?

It was something I was genuinely interested in so motivation was an easy find. In fact, finding time was the harder bit but I had the most supportive ecosystem at home and at work which made this an easier journey.

What do reviewers say about it?

While I await professional reviews, this is typical of what I’m hearing from actual people who have read it:

“The Macro Faire is a perfect bridge between the world of Academics and its practical application as far as Macro Economics goes. I wish I would have had the privilege of something like this when I started out my career in Equities. Needless to say it’s a useful read even for professionals who often in the day to day work schedule overlook the basics in search for the complex. And this book is uniquely Indian!”

I feel very grateful that I could contribute to people’s understanding and add some value to my peers.

What were your highlights from studying at Warwick?

I remember it being the most amazing time of my life - so much greenery, clean air, endless opportunities of knowledge enhancement and a fantastic peer set. Warwick still feels like home. It brings a very warm sense of nostalgia.

Among other things, the curriculum was amazing. The choice of electives were relevant. It was a very enriching time of my life. It is impossible to believe the amount of work and travel I was able to fit in one year.

What was your favourite module and why?

I think it was Public Policy. At that time, I was very keenly interested in the differences in public policy in emerging and developed economies. Coming from India, some cases and class discussions were not just engaging but also eye opening. They made me have a very different lens and perspective to the world- something that I did not have before.

Do you keep in touch with your fellow students from Warwick?

Yes, we did an all-girls trip 3 years after graduation. However, then covid-19 interrupted us. I have been to their countries and I have hosted 4 of my Warwick friends in India. We talk almost every week and we keep sharing Instagram stories/other trivia to keep it going. It doesn’t feel like it’s been many years, it always feels like we just were together last week or something.

And finally, what are your next steps now that the book is published?

In my last job, I was the lead economist with DSP Asset Managers in Mumbai. As of today, I’m enrolled in the MBA programme at INSEAD.

This is turning out to be another gruelling but exciting experience! I think some of us just always want to learn and I’m beginning to recognize myself as someone who’s always curious. I’m learning a lot every day and I hope to use the knowledge to advance myself and my country someday.

Here is a link to more information about Ankita's book The Macro-Faire: An Investor's Guide to MacroeconomicsLink opens in a new window

How university skills transformed my business: Warwick Economics alumnus and entrepreneur reflects on his economics degree

We all recognise that what we learn at university can have a long-lasting effect on our lives, shape our careers and have a wider impact on society. But it can also teach us a range of practical skills beyond our expectation, skills that can empower us to make different choices and apply them successfully to problem solving in a business context.

Meet Shishir Garg, Warwick Economics graduate of class 2018 and second-generation entrepreneur based in India, who reflects on how his degree course in economics transformed him and his ability to apply economic knowledge in real life situations. After graduating with a BSc in Economics from Warwick, with an Examiners’ Prize for Best Performance in Research in Applied Economics, Shishir stayed on at Warwick as a Research Assistant for Professor Thiemo Fetzer who had been his personal tutor and dissertation supervisor. Before moving back to India, Shishir undertook an MPhil in Economics and Finance at Cambridge and then became a consultant at the World Bank.

Now Shishir runs R.P Poly Plast Ltd, a leading manufacturing company in the city of Kanpur, India. Shishir attributes the success of his business to his ability to implement economic techniques he learnt during his time at Warwick and Cambridge.

We ask Shishir a series of questions about his enterprise and how he perceives the connection between academia and business.

Could you tell us more about your business and the economic impact it is having in Kanpur and the surrounding region?

Our business interests include manufacturing edible oils (such as rice bran oil and soyabean oil), high density Polyethylene based tarpaulin and Polypropylene based woven sacks and fabric. Our most recent venture is to manufacture expanded polyethylene sheets and rolls which are used in mattresses, packaging, furniture, and consumer goods. This new manufacturing unit will provide employment for about a hundred people who come from rural backgrounds and live under extreme poverty.

How is it possible for an economics graduate to run a manufacturing business without a scientific or science technology background?

I strongly believe that if you are provided with the right skills or tools, you can solve any problem that comes your way. I have come to observe and appreciate how my experience, at world class universities under top professors, equipped me to handle problems, implement novel techniques and put theories into practice. These skills are especially hard to come by in my part of the world, so I can truly say that my university education has had a huge positive influence on my life.

What were the most important lessons you learned during your time at Warwick?

My undergraduate tutor at Warwick, Professor Thiemo Fetzer, always taught me to think differently and to approach the unique challenges that each research paper brings in a structured way. The challenge can be anything: from considering how proxies can be used if there is not enough data available to deciding which economic technique would be most suitable to apply.

This was especially liberating as sometimes in undergraduate study things are structured in such a way that you have to find answers in quite a defined and rigid manner. But in practice, you get a lot of curveballs and there are no set answers. Professor Fetzer really taught me how textbook economics is deployed in real life through his work and the research I did for him.

I especially learnt a lot from him while I was working on my undergraduate dissertation, under his tutelage, for which I was awarded the Department prize. During that time, I got a good grasp of what a research paper looks like and the importance of finding the mechanisms through which changes are taking place. Previously my understanding of research was based on preconceived notions such as finding a result by running regressions in Stata and finding the significance of a variable by looking at the p-value, rather than considering the wider context and economic theory.

How have you applied your economics skills to improve your business practices?

After I graduated I worked as a research assistant for Professor Fetzer for four years. I got to work on some amazing projects and learn about the best research methods and economic techniques. The skills I learnt have helped me immensely to transform the business. For instance, there are lot a of manufacturing steps involved in refining edible oils. A small change in temperature or pressure at any step may lead to a huge change in the yield and quality of oil. Virtually no data on this was being documented before. However, since I joined the business, we have implemented a variety of novel data collection techniques using various instruments and field experiments to isolate how a change in one variable affects the final product.

Through such techniques, we have developed an unparalleled understanding of the mechanisms and variables which alter the composition of oil. This, in turn, has significantly reduced our costs while enhancing the quality of our oils. These changes would certainly not have been possible without the knowledge of economic techniques gained during my time at university.

Could you tell us more about the sustainability initiatives that your business invests in?

Our new manufacturing unit is unique due to a plethora of factors. Foremost, half of the energy consumption will come from the grid-connected 250 KW Solar rooftop installed on our plant (pictured above). It was installed in collaboration with Tata Power, the premier solar manufacturer in India. This is especially important given that India meets most of its power needs by burning fossil fuels such as coal. Given the fact that heatwaves are becoming common in India, this will help tackle climate change in a small way. This programme is just the tip of the iceberg as we plan to generate 1 MW of solar energy in house at our manufacturing units.

Secondly, all the waste generated in the manufacturing process will be recycled through a first-of-its-kind recycling machine whereby the recycled product can again be reused to make the sheets and rolls. Moreover, there will be zero water discharge as water used in the manufacturing process will be recycled and reused again.

Shishir Garg, BSc Economics 2018