‘Big Oil’ and Decarbonisation: the ‘Transition Strategy Continuum’

Blog post by Dr Mathieu Blondeel, Research Fellow, March 2021

Decarbonisation & Transition Risks

To achieve the Paris Agreement’s target to limit temperature increase to 1.5°C, oil consumption must drop 34 percent this decade and production must decline 4 percent year-on-year. Although this is very ambitious, accelerating government and business action on climate change is already exposing ‘transition risks’, the broader financial implications of the transition process towards a low-carbon economy for a wide range of stakeholders, beyond the global oil industry itself.

Publicly traded international oil companies (‘IOCs’ such as BP, Shell and ExxonMobil) are far more vulnerable to transition risks than their state-owned rivals (NOCs). In a carbon-constrained world, the lowest cost and least carbon-intensive oil will probably be produced the longest. The NOCs sit on the largest reserves and they have kept the ‘easy oil’ to themselves. The IOCs also face a higher risk of losing their ‘social licence to operate’ as well as growing shareholder pressure on climate accountability.

Long before the Covid-19 pandemic, the industry was already in distress. The largest IOCs have suffered from chronic cash shortfalls and have resorted to stopgap asset sales and long-term debt to bridge their deficits. Some suggest that the fossil fuel industry is now sitting on a ‘carbon bubble’, with US$ 30 trillion in fixed assets at risk of becoming ‘stranded’. Events in 2020 only increased transition risk exposure. The S&P 500’s listed energy companies lost more than a third of their combined value in 2020, while the entire index rose by 18 percent. The crisis has led to drastic cuts in dividends, layoffs, reduced capital investments and operational expenditure. The contrast couldn’t be any bigger with renewable players.

The oil industry is now also increasingly threatened by global fossil fuel divestment campaign, as well as growing net-zero commitments by financiers and asset owners. As climate policy gains greater traction, finance streams dry up, social preferences change, and transition risks pile up, Big Oil must act, whether they want to or not.

The ‘Transition Strategy Continuum’

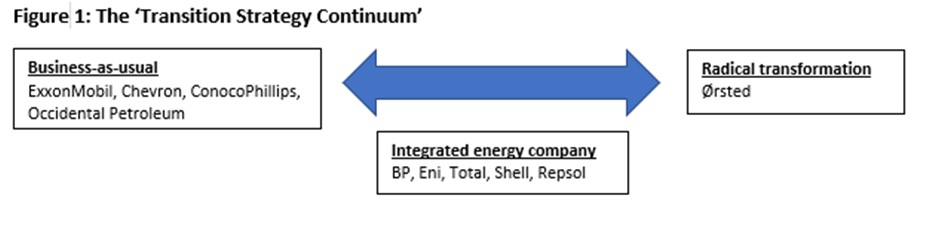

In the face of these challenges, what are Big Oil’s coping strategies, and how credible are they? One way of analysing this, is through our novel prism of the ‘transition strategy continuum’. Discrete strategies range from a conservative ‘business-as-usual’ strategy where a company, at best, addresses its own emissions, to one of ‘radical transformation,’ which entails a complete overhaul of the business model. To determine the position of an IOC, we analyse three criteria: 1) current and future investments in renewables and low-carbon technologies (compared to oil and gas); 2) emissions and production reduction targets; 3) discrete oil demand outlooks.

Radical Transformation

The first, and most far-reaching, strategy is one of radical transformation. The Danish majority state-owned energy company Ørsted, formerly known as Dong Energy, is the clearest example. In just over a decade, it has transformed from a conventional fossil energy company to the world’s largest producer of offshore-wind energy, selling off its last oil and gas upstream assets in 2017. Now it has one long-term goal: to become the world’s first ‘green energy supermajor.’ But Dong was a relatively small company compared to veritable Majors, such as ExxonMobil, Shell, BP, Total, and Chevron. None of these has (yet) followed suit.

Integrated Energy Companies

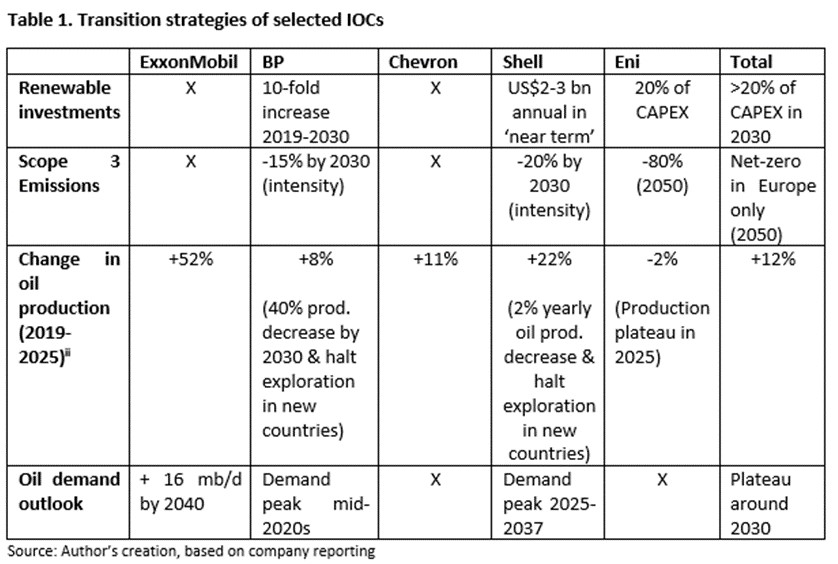

The second strategy is one of becoming an integrated energy company. Let us first look at investments. Since 2015, Total, has allocated more than 10 percent of its investments to renewables and electricity, more than any other IOC. That share is expected to increase to more than 20 percent by 2030 at the latest. Early 2021, it has proposed to share its name to TotalEnergies to better capture its “strategic transformation into a broad energy company.”

It was also the first major to leave the powerful oil lobby, the American Petroleum Institute, citing differences over climate policy. This move exposes the growing discord over climate policy, particularly between the European and American ones.i Another European major, BP, aims to increase its annual low carbon investment 10-fold to around US$5 bn a year by 2030, while Shell will increase their investments to a more modest US$2-3 bn in the “near future.”

In terms of emissions targets, these IOCs have now committed to becoming ‘net-zero’ by 2050 at the latest, even though this remains a contested concept. Repsol and Eni have both announced that they will eliminate all emissions from their own operations and those of their customers by 2050, including their (in)famous scope 3 emissions (which account for up to 90 percent of IOC emissions). Total announced that its scope 3 emissions would reach net zero by 2050 as well, albeit only in Europe. Shell and BP’s scope 3 ambitions are more modest and relate to emissions intensity. But both have been working on integrating emissions reduction targets into the bonus packages of part of its workforce.

BP is also taking the most meaningful steps in production targets. By 2030, its oil and gas production are expected to reduce by 40%, from 2019 levels. It will also stop exploration in new countries. Importantly, this does not apply to the operations of the Russian oil producer, Rosneft, where BP holds a significant minority stake. Eni expects its oil and gas production to plateau in 2025, while Shell refers to a peak in oil production alone; which already occurred in 2019.

Importantly, forecasting and scenario analyses also give a good indication of the internal thought processes within these companies. In 2018, Shell was the first to outline a Paris-compliant scenario; which it updated in 2021 to be 1.5°C-compatible. Although several executives quit amid a split over the strategy. Others as well have scenarios that use the Paris Agreement as a benchmark and forecast a peak in global oil demand relatively soon.

Business-as-Usual

The third, business-as-usual strategy basically entails doubling down on the core business of oil production, even if it does involve making some, often cosmetic, changes related to investment and emissions reduction strategies. ExxonMobil perhaps best exemplifies this. CEO Darren Woods has recently said that “today’s alternatives [to oil] don’t consistently offer the energy density, scale, transportability, availability, and most importantly the affordability required to be widely accepted.” Consequently, it has shown very little investment interest in renewable energy. Instead it has a more persistent focus on emissions reduction technologies, most notably carbon capture and storage and hydrogen.

It has also long held out against investor pressure over climate change. Although recently, it accepted to cut scope 1 & 2 emissions by 2025 and to start publishing annual data on its scope 3 emissions. Internal documents have revealed, however, that it expects annual emissions from its operations to increase from 122 million metric tons of CO2 in 2017 to 143 million metric tonnes in 2025.

Despite total reserves dropping by a third and writing off up to US$20 bn in assets in 2020, in the short term, ExxonMobil plans to boost oil and gas production because it expects oil demand and prices to rise while the world recovers from the Covid-19 crisis and global oil supply growth slows because of current under-investments. Some analysts now project oil prices going above and beyond US$100 a barrel as we have supposedly entered a new ‘commodities supercycle.’ In the long term, ExxonMobil expects that the equivalent to Saudi Arabia’s daily production will be needed to meet projected demand growth by 2040.

Other American majors, like Chevron and ConocoPhillips, follow a similar strategy.

The table above shows that there is indeed a clear divergence in strategy, based on the three criteria. But even for those aiming to transform into an integrated energy company, the emphasis will continue to rest on their core oil and gas business a while yet. In the short term, a difficult balancing act lies ahead, which will require ambidexterity (or the ability to both explore new avenues and exploit existing ones): IOCs must maintain a positive cash flow to reward investors and also finance a re-positioning strategy come.

Quo vadis?

The history of capitalism is one of the ‘creative destruction’ of corporations and industries that failed to adapt to new realities. If it does not act, Big Oil faces a similar fate as Kodak in the 1990s or Nokia and BlackBerry in the 2000s.

But it still has a few tricks up its sleeve. Current upstream under-investment will likely lead to supply shortages and prices have gone up now that the pandemic’s end is possibly in sight. Moreover, the fossil fuel industry has also enjoyed (in)direct financial support as governments around the world disproportionately advantaged carbon-intensive sectors through their Covid-19 rescue packages. Signs that the world is not yet done with oil.

But we are at the start of a crucial decade in the fight against climate change. To maintain a reasonable chance of keeping global warming within the Paris Agreement’s limits, both oil use and production must peak soon and come down very swiftly. In this context, the only climate-viable strategy in the longer-run is that of radical transformation.

It is vital to manage a rapid transition in such a way that it happens in as orderly a manner as possible. Given the centrality of oil to the current global financial system, the stakes could not be higher. The fundamental question these companies face is whether they can (or care to) reinvent their business models within planetary boundaries or whether they want to risk continuing down a path that has already cost them so much in the past decade.

Notes:

i Total and Shell withdrew from a related organisation in 2019, the American Fuel & Petrochemical Manufacturers; followed by BP in 2020.

ii Change in oil production 2019-2025 is based on figures provided in OCI, 2020, p. 3.

“Mathieu Blondeel is a postdoctoral Research Fellow at the Warwick Business School (WBS) where he is working on a project “UK Energy in a Global Context”, funded by the UK Energy Research Centre (UKERC). This blog is based on a book chapter he co-authored with Professor Michael Bradshaw (WBS) for a forthcoming edited volume Handbook of Oil and International Relations (Edward Elgar).”