WBS UK Probabilistic Forecasts, Feb 2017

WBS Forecasts for 2017 and 2018

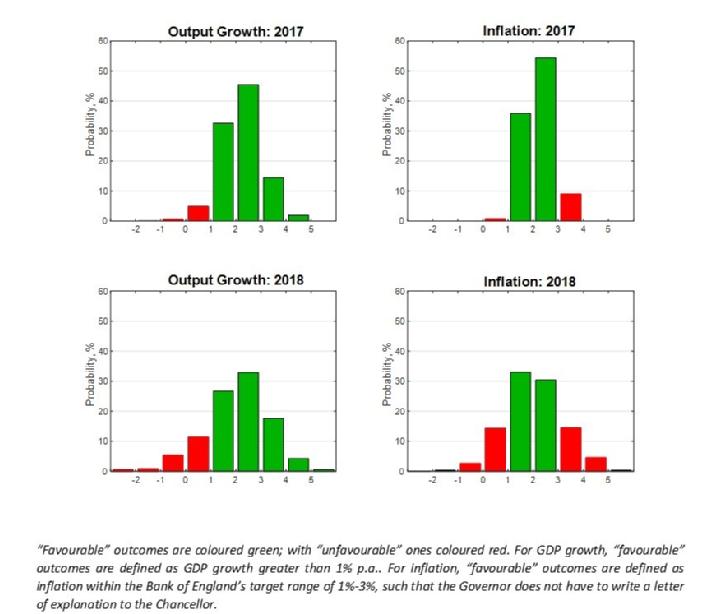

The figure below presents WBS’s latest (as of 22nd February 2017) probabilistic forecasts for real GDP growth and inflation – for 2017 and 2018 – as histograms.

Inspection of both the figure and Table 1 below reveals that any (downward) Brexit effect on GDP growth has still to show up in WBS’s forecasts, with economic growth set to continue through 2017 and 2018. There is, however, downside risks to GDP growth specifically in 2018, with a one-in-five chance that growth dips below 1%. But assuming historical patterns in the currently available data do repeat themselves, economic growth in the UK as forecast by the WBSFS is still most likely to continue into 2018 at a rate between 2% and 3%. But Brexit, of course, may well change this and lead to the breakdown of historical patterns and relationships in macroeconomic data.

Consistent with the depreciation of the pound since the referendum last June, inflation is strongly predicted by the WBS forecasting system to pick up in 2017 and 2018; and relative to one quarter ago the system’s forecasts have been strongly revised upwards.

Table 1: Probability Event Forecasts for Annualised % Real GDP Growth and CPI Inflation

Year |

Real GDP Growth (%, p.a.) |

CPI Inflation (%, p.a.) |

|||

|

|

Prob(growth<1%) |

Prob(growth<2%) |

Prob(letter) |

Prob(CPI<1%) |

Prob(CPI>3%) |

2017 |

5% |

38% |

10% |

1% |

9% |

2018 |

18% |

44% |

37% |

18% |

19% |

Comparison with other forecasters

The main objective of the WBS forecasting system is to provide benchmark and judgement-free probability forecasts; and to assess the risks associated with other forecasts when these do not involve a direct communication of forecast uncertainty.

Accordingly, we take the most recent forecasts from the Bank of England, HMT’s Panel of Independent Forecasters and the IMF (from their forecast update this January). While the Bank of England provides an explicit assessment of forecast uncertainties for the UK, via “fan charts”, the HMT Panel and IMF provide point forecasts only.

We use the WBS forecasting system histograms to compute the probability that GDP growth or inflation is greater than the other forecaster’s “point” forecast. If the point forecast from the other forecaster falls in the centre of the WBS forecast distribution we would expect this probability to be 50%. On the other hand, if the forecaster is more optimistic (pessimistic) than we suggest they should have a probability less (greater) than 50%.

Table 2: Forecast Comparison for 2017

|

|

Real GDP Growth (%, p.a.) |

CPI Inflation (%, p.a.) |

||

|

|

Point Forecast |

Prob. of a higher outturn |

Point Forecast |

Prob. of a higher outturn |

Bank of England[1] |

1.84 |

0.69 |

2.61 |

0.23 |

HMT Panel |

1.60 |

0.80 |

2.60 |

0.23 |

IMF |

1.50 |

0.83 |

n/a |

n/a |

Looking at GDP growth, Table 2 shows that, relative to one quarter ago, and in particular the Bank of England, have revised up their GDP growth forecasts for 2017 closer to the values the WBSFS has been predicting since Brexit. They nonetheless remain more pessimistic about GDP growth in both 2017 and 2018 than the WBSFS. This is consistent with the view that Brexit has yet to disrupt historical relationships between macroeconomic variables; and accordingly these forecasters’ central forecasts are more-in-line with the judgement-free forecasts produced by the WBSFS.

Table 3: Forecast Comparison for 2018

|

|

Real GDP Growth (%, p.a.) |

CPI Inflation (%, p.a.) |

||

|

|

Point Forecast |

Prob. of a higher outturn |

Point Forecast |

Prob. of a higher outturn |

Bank of England[1] |

1.60 |

0.68 |

2.65 |

0.24 |

HMT Panel |

1.40 |

0.74 |

2.80 |

0.24 |

IMF |

1.40 |

0.74 |

n/a |

n/a |

Tables 2 and 3 also reveal how the Bank of England, HMT and IMF are more confident that inflation will turn out higher than historical patterns in the data lead the WBSFS to expect. But, relative to one quarter ago, the three forecasters’ central forecasts fall much closer to the centre of the WBSFS histogram forecasts shown in the figure. This reflects the upward revision to WBS’s forecasts for inflation in both 2017 and 2018, following recent rises in UK inflation following the depreciation in the pound since Brexit. The WBSFS now predicts a 63% chance that inflation rises above 2% in 2017 compared with a 21% probability forecast one quarter ago.

Note on the Warwick Business School Forecasting System

The Warwick Business School Forecasting System communicates forecast uncertainties for UK GDP growth and inflation in an open and transparent way – free from judgement. The system involves consideration of a range of cutting-edge econometric forecasting models, as opposed to relying on a single model which is likely misspecified.

Focus is on the production and publication of accurate probabilistic forecasts, using statistical methods, rather than constructing a narrative or story around one particular, but likely far from certain, possible set of outturns.

The WBS forecasts thus emphasise forecast uncertainties; and provide a benchmark against which one can assess the plausibility of other forecasts.

[1] The Bank of England (mean) forecasts for calendar year inflation are derived from their published forecasts for the four-quarter inflation rate and are, therefore, to be treated as approximate.