WBS UK Probability Forecasts, May 2016

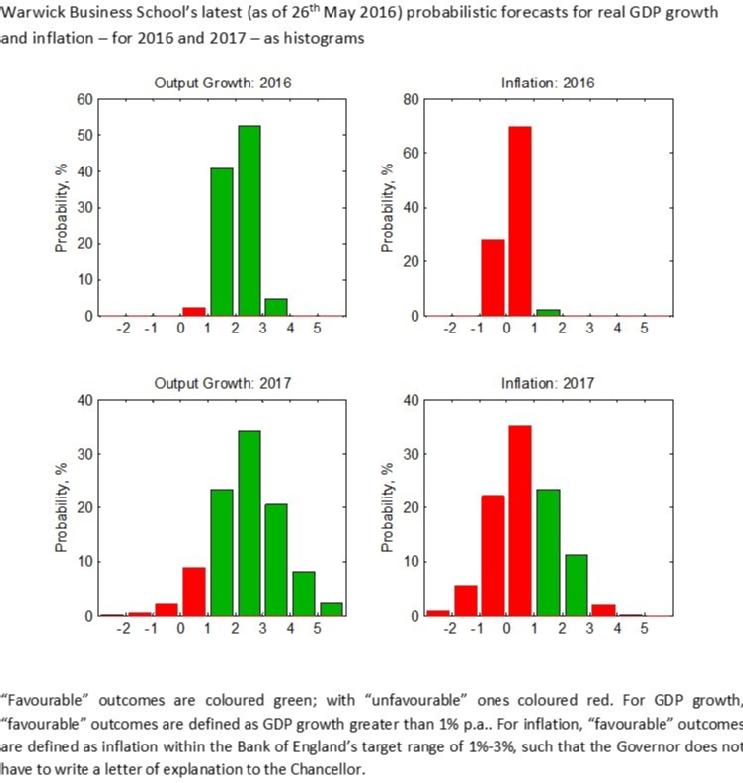

Inspection of the figure reveals that economic growth in the UK is expected to continue through 2016 and 2017, with the most likely outcomes being growth of between 2% and 3%. Any economic uncertainty associated with “Brexit” has not as yet changed the balance of risks to economic growth relative to our forecasts a quarter ago. This contrasts recent downward revisions to forecasts from the IMF and the HMT Panel of Independent Forecasters. The WBS forecasting system estimates only a 2% chance of growth less than 1% in 2016; and an 11% chance of growth less than 1% in 2017. But a vote to exit could significantly change these forecasts.

The most likely forecast outturns for inflation in 2016 and 2017 will, as in 2015, involve letters of explanation from the Bank of England Governor, as inflation is again strongly predicted to fall beneath its 1% targeted lower bound. This follows UK inflation recently hovering around zero due to weaker oil and food prices.

The WBS forecasting system has revised upwards these probability forecasts of low inflation and deflation in 2016 as a whole, as more evidence of low inflation has accumulated during 2016 so far. It estimates that it is near-certain that inflation is less than 1% in 2016, relative to a one-in-two chance three quarters ago; and estimates nearly a one-in-three chance of deflation in 2016 relative to little more than a one-in-ten chance three quarters ago. In 2017, there remains a three-in-five chance of inflation less than 1% and a one-in-four chance of deflation. Our forecasts, therefore, point to a sizeable risk that this low inflation persists over the next couple of years. But this appears to be “good” low inflation, given that GDP growth is expected to continue.

Event Forecasts

From the WBS forecast histograms we extract the following forecasts.

Table 1: Probability Event Forecasts for Annualised % Real GDP Growth and CPI Inflation

|

Year

|

Real GDP Growth (%, p.a.)

|

CPI Inflation (%, p.a.)

|

||||

|

|

Prob(growth<0%)

|

Prob(growth<1%)

|

Prob(growth<2%)

|

Prob(letter)

|

Prob(CPI<1%)

|

Prob(CPI>3%)

|

|

2016

|

<1%

|

2%

|

43%

|

98%

|

98%

|

<1%

|

|

2017

|

3%

|

11%

|

34%

|

65%

|

63%

|

2%

|

Table 1 indicates that “robust” GDP growth, around pre-crisis trend growth rates, is expected in 2016. There is a 57% chance of growth greater than 2% in 2016 and a 66% chance in 2017.

The risks to inflation in 2016 and 2017 continue to be on the downside, with a 98% chance that inflation is less than 1% in 2016. The probability of inflation greater than 3% is forecast to be essentially zero in 2016, rising to a modest 2% in 2017. The WBS forecasting system therefore continues to place a higher probability on the currently low inflation in the UK persisting, consistent with the downward revision in inflation forecasts by the Bank of England and other forecasters in recent months.

Comparison with other forecasters

The main objective of the WBS forecasting system is to provide benchmark and judgement-free probability forecasts; and to assess the risks associated with other forecasts when these do not involve a direct communication of forecast uncertainty.

Accordingly, we take the most recent forecasts from the Bank of England, the IMF and HMT’s Panel of Independent Forecasters. While the Bank of England provides an explicit assessment of forecast uncertainties for the UK, via “fan charts”, the IMF and HMT Panel provide point forecasts only.

We use the WBS forecasting system histograms to compute the probability that GDP growth or inflation is greater than the other forecaster’s “point” forecast. If the point forecast from the other forecaster falls in the centre of the WBS forecast distribution we would expect this probability to be 50%. On the other hand, if the forecaster is more optimistic (pessimistic) than we suggest they should have a probability less (greater) than 50%.

Table 2: Forecast Comparison for 2016

|

|

Real GDP Growth (%, p.a.)

|

CPI Inflation (%, p.a.)

|

||

|

|

Point Forecast

|

Prob. of a higher outturn

|

Point Forecast

|

Prob. of a higher outturn

|

|

Bank of England1

|

2.14

|

0.45

|

0.44

|

0.27

|

|

HMT Panel

|

1.90

|

0.61

|

0.70

|

0.10

|

|

IMF

|

1.90

|

0.61

|

0.80

|

0.07

|

Table 3: Forecast Comparison for 2017

|

|

Real GDP Growth (%, p.a.)

|

CPI Inflation (%, p.a.)

|

||

|

|

Point Forecast

|

Prob. of a higher outturn

|

Point Forecast

|

Prob. of a higher outturn

|

|

Bank of England1

|

2.24

|

0.57

|

1.27

|

0.28

|

|

HMT Panel

|

2.10

|

0.61

|

1.60

|

0.20

|

|

IMF

|

2.20

|

0.58

|

1.90

|

0.15

|

Looking at GDP growth, Tables 2 and 3 indicate that the point forecasts from the Bank of England, HMT Panel and the IMF fall close to the centre of the range of estimates expected by the WBS forecasting system. However, there is evidence that the WBS forecasting system is slightly more optimistic about growth in 2017 than the other forecasters.

For inflation there is more disagreement. The WBS forecasting system is more confident than the other forecasters that the current low inflation rates in the UK will persist through 2016 into 2017. This is evidenced by the fact that the inflation point forecasts for 2016 and 2017 from the other three forecasters clearly fall in the right-hand-side of the WBS forecasting system histogram. The system accordingly suggests that, depending on the forecaster examined in Table 3, there is between a 72% and 85% chance that inflation falls below their central expectations for 2017.

Note on the Warwick Business School Forecasting System

The Warwick Business School Forecasting System communicates forecast uncertainties for UK GDP growth and inflation in an open and transparent way – free from judgement. The system involves consideration of a range of cutting-edge econometric forecasting models, as opposed to relying on a single model which is likely misspecified.

Focus is on the production and publication of accurate probabilistic forecasts, using statistical methods, rather than constructing a narrative or story around one particular, but likely far from certain, possible set of outturns.